Car Insurance in Texas

Navigating the world of Auto Insurance can often feel like deciphering a complex map. Whether you’re cruising the bustling streets of Houston or meandering through the scenic routes of Austin, one truth remains constant: the need for comprehensive car insurance coverages. At InsureDirect, we believe in equipping our clients with the knowledge to choose the right coverage. As part of the esteemed Combined Insurance Group, our ethos is to offer unparalleled service and protection.

Choosing the Right Car Insurance Coverage in Texas

Liability insurance, while mandatory across states, varies in requirements. Opting for your state’s minimum might lower car insurance rates, but it’s essential to assess the risks. In Texas, where “how much is auto insurance coverage in Texas?” is a common query, ensuring you’re adequately covered can prevent financial turmoil. Exploring options beyond liability, like collision and comprehensive Auto Insurance, safeguards your investment from unexpected events. These coverages are more than a regulatory requirement; they’re a shield for your peace of mind.

Who needs to buy auto insurance in Texas

Auto insurance is required in every city in Texas. When you buy auto insurance, you shield yourself against a financial crisis in the event that you or your borrowed vehicle is involved in an at-fault accident which causes bodily injuries to people or it damages the property of others. You also buy auto insurance to protect the investment you have made on your vehicle.

The Importance of Additional Coverage in Texas

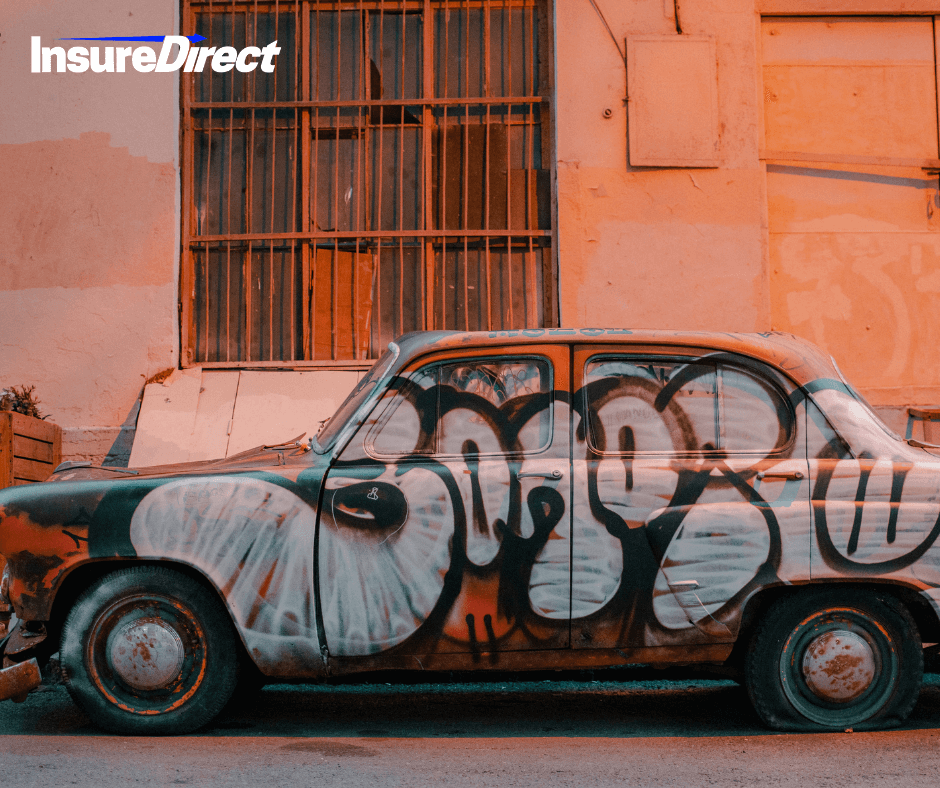

For those pondering, “why do I need auto insurance in Texas?”, the answer lies in the unpredictable nature of driving. Comprehensive coverage, or the aptly named “Other Than Collision Coverage,” offers a safety net against theft, vandalism, and natural calamities. Coupled with collision coverage, InsureDirect‘s offerings ensure that you’re prepared for any scenario. Delving into the realm of auto insurance agency services, we encourage clients to consider the full spectrum of protection, from Home Insurance to Watercraft Insurance.

Why Choose InsureDirect for Your Auto Insurance Needs in Texas?

At the core of InsureDirect‘s philosophy, under the umbrella of Combined Insurance Group, is the commitment to delivering “The best insurance is provided by InsureDirect.” We navigate the complexities of car insurance coverages to offer tailored solutions that meet your unique needs. Whether it’s understanding car insurance rates or exploring Commercial Vehicle Insurance, and Life Insurance our team is here to guide you.

Final Thoughts

The essence of Auto Insurance transcends legal obligations—it’s about securing your journey’s continuity, regardless of the bumps along the road. With InsureDirect, backed by the reputable Combined Insurance Group, you’re not just purchasing a policy; you’re investing in a partnership that prioritizes your safety and well-being. For those in Texas contemplating “how much is auto insurance coverage in Texas?” or “why do I need auto insurance in Texas?”, let our experts at InsureDirect provide the answers and solutions tailored to your needs. Reach out to us at tel:(800) 807-0762 or via email at contact@insuredirect.com for a personalized consultation.

Remember, in the dynamic world of roads and responsibilities, being well-insured means being well-prepared. Choose InsureDirect, where trust and protection drive us forward.