Renting a home sets you free — no yard maintenance, no property taxes, no leaky roof payments. But it also means you don’t own the walls that protect your belongings. And that’s where most renters go wrong: they assume the landlord’s insurance covers everything. It doesn’t. That’s exactly why renters insurance exists — to protect you and your possessions, not the building.

Learning About Renters Insurance: The Essentials

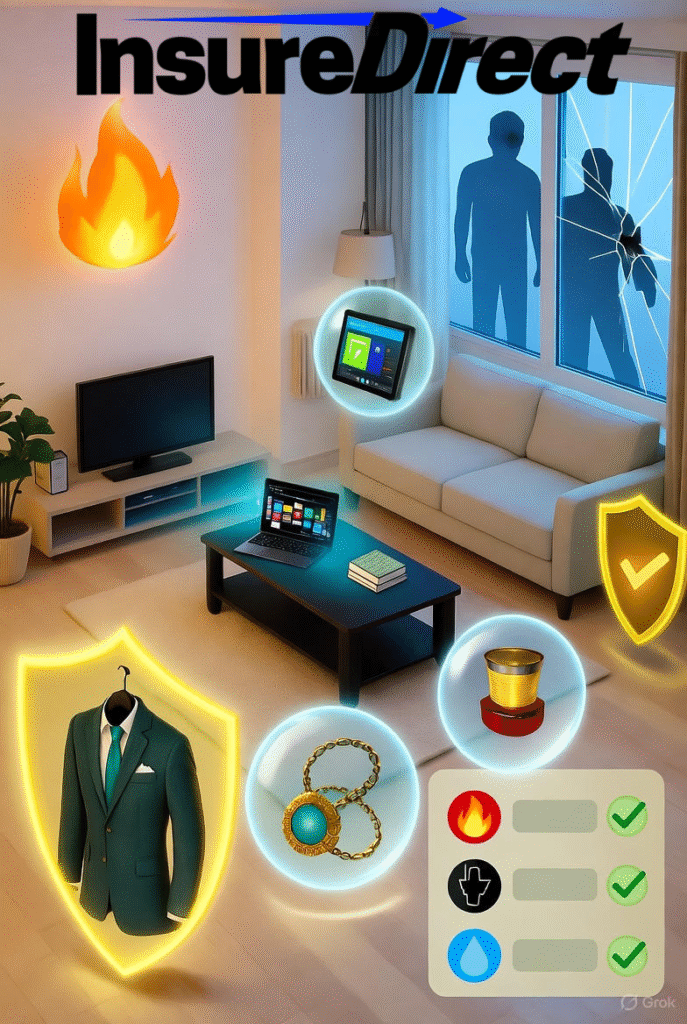

Renters insurance, also called tenant insurance, is a financial safety net designed to protect your property, liability, and temporary living expenses if something goes wrong.

Whether a fire, theft, or burst pipe wreaks havoc, this coverage ensures you can recover without dipping into your own savings.

While the word “insurance” often evokes images of paperwork and high costs, renters’ insurance is affordable and simple. Most policies cost less than your daily cup of coffee, making it one of the easiest ways to secure peace of mind.

What Does Renters Insurance Cover?

While wording may vary by provider, most policies cover three main pillars: personal property, liability, and additional living expenses (ALE).

1. Personal Property Protection

This coverage reimburses you if your belongings are lost, damaged, or destroyed by covered events — for instance, fire, smoke, vandalism, or windstorms.

Take a moment to think about your apartment: your laptop, phone, furniture, clothing, kitchen appliances, and décor. One disaster could cost thousands to replace. Renters insurance ensures you’re reimbursed to recover and replace these items.

Most insurers offer two types of coverage:

- Actual Cash Value (ACV): Pays what your items are worth today, factoring in depreciation.

- Replacement Cost Value (RCV): Pays what it would cost to buy new replacements.

Whenever possible, choose replacement cost coverage. Yes, it’s slightly more expensive, but it spares you the headache of buying used replacements for essential items after a fire or theft.

2. Liability Coverage

Liability coverage protects you when accidents happen, like if someone is injured in your apartment or you accidentally damage someone else’s property.

Examples:

- A guest slips on a wet floor.

- You knock over a candle, causing a small fire.

- Your pet bites a delivery person.

Without liability coverage, you could be personally responsible for medical expenses, repair costs, or legal fees — which can escalate quickly.

3. Additional Living Expenses (ALE)

If a covered disaster renders your apartment uninhabitable, ALE covers temporary housing, meals, and other costs while repairs are made.

It prevents situations where you’d need to live in your car or rely on friends for extended periods after a catastrophe.

What Renters Insurance Doesn’t Cover

While renters insurance is powerful, it isn’t all-encompassing. Common exclusions include:

- Flooding: Requires a separate flood policy.

- Earthquakes: Usually excluded unless added as an endorsement.

- Pest damage: Mice, termites, and bedbugs are not covered.

- Roommate property: Their belongings are not insured under your policy.

- High-value items beyond limits: Jewelry, collectibles, or art may need special coverage.

Optional endorsements or floaters can protect high-value possessions like engagement rings, musical instruments, or cameras.

Why Renters Insurance Is Worth It

You might wonder: why purchase renters’ insurance if your landlord has coverage? The answer is simple: the landlord’s policy protects the building — not your belongings.

Lightning strikes or a fire damages your apartment? Your landlord gets reimbursed for the building. You get nothing unless you have your own policy.

1. Affordable Protection

Most renters pay $15–$25 per month. That’s roughly the cost of two pizzas or a couple of specialty coffees. For such a small price, you gain financial security worth thousands, protecting your property and peace of mind.

2. Coverage Beyond Your Apartment

Renters insurance doesn’t just protect items inside your home. Many policies cover personal property anywhere in the world.

laptop stolen from your car? Covered. Backpack snatched at the airport? Covered. This global protection often surprises renters when it comes in handy during travel mishaps.

3. Legal Protection

Even minor accidents can result in costly lawsuits. Liability coverage protects you from financial ruin if a guest is injured or if your actions accidentally damage someone else’s property.

4. Landlord Requirements

Some landlords now require tenants to maintain renters’ insurance. Even if it’s not mandatory, having your own policy shows responsibility and protects both you and your landlord in case of accidents.

How Much Renters Insurance Do You Need?

Coverage levels vary depending on what you own and your lifestyle.

- A minimalist studio may need around $20,000 in personal property coverage.

- A fully furnished two-bedroom could require $60,000 or more.

Tip: Create a home inventory. List all valuable items — electronics, clothes, furniture, décor, kitchenware, and sporting equipment. This ensures you purchase sufficient coverage to replace everything in a total-loss scenario.

Tips to Lower Your Renters Insurance Premium

- Bundle policies: Combine auto and renters insurance to save.

- Add security devices: Deadbolts, alarms, and smart locks reduce risk.

- Increase deductibles: Pay slightly more out-of-pocket, reduce monthly premiums.

- Maintain good credit: Insurers often reward responsible financial behavior.

- Shop annually: Rates fluctuate; comparison can save money.

Even minor adjustments can lead to significant savings.

Common Myths About Renters Insurance

- Myth #1: “I don’t have enough to insure.”

Even minimal possessions often exceed tens of thousands in replacement costs. - Myth #2: “It doesn’t cover accidents.”

Liability coverage is one of the most valuable components, paying for medical and legal costs. - Myth #3: “It only covers inside my apartment.”

Policies frequently cover belongings anywhere in the world, including travel or public spaces. - Myth #4: “It’s complicated.”

Online quotes can be generated in 10 minutes or less, making the process straightforward.

The Emotional Value of Renters Insurance

Insurance isn’t just about dollars — it’s peace of mind. Knowing you won’t be financially devastated by an unexpected event reduces stress. Fires, thefts, and natural disasters are already upsetting. Renters insurance provides stability and a sense of control in uncertain times.

Losing photos, clothing, or electronics overnight is traumatic. While a claim check won’t restore memories, it enables you to rebuild faster and more smoothly.

Simple Tips for Filing Claims

- Notify your insurer immediately.

- Document damages — photos, receipts, and videos help.

- Submit claims promptly.

- Communicate openly with adjusters for faster resolution.

Honesty and timely reporting can accelerate payouts.

Roommates and Renters Insurance

If you live with roommates, everyone should maintain their own policy. Renters insurance covers only the named policyholder. Sharing a policy may seem cheaper but it complicates claims.

Encourage roommates to purchase their own coverage — it’s inexpensive and avoids future disputes.

Special Coverage Options

Customizable add-ons include:

- Identity theft protection: Reimburses expenses from stolen identity.

- Pet liability: Covers injuries caused by pets.

- Earthquake coverage: Essential in quake-prone areas.

- Home business coverage: Protects equipment used for work.

A short discussion with your insurer ensures your unique lifestyle is fully covered.

Choosing the Right Provider

Not all insurers are the same. Beyond price, check:

- Customer service reviews

- Claim response times

- Financial strength

- Available discounts

Popular insurers include State Farm, Allstate, Lemonade, Progressive, and Nationwide, but local providers sometimes offer better rates or personalized service.

Digital Convenience

Modern renters insurance is tech-friendly:

- Instant online quotes

- Online policy management

- Claims submitted via apps

- Real-time status updates

Technology simplifies coverage and keeps everything organized.

Renters Insurance vs. Homeowners Insurance

Homeowners insurance covers the building and structure; renters insurance protects personal belongings. Homeowners rebuild; renters replace their stuff. Same concept, different financial responsibility.

Real-Life Scenarios

- Kitchen fire: Insurance replaced damaged furniture and paid for temporary housing.

- Vacation theft: Electronics stolen during a break-in were replaced promptly.

- Guest injury: Liability coverage covered medical bills entirely.

Low monthly premiums can prevent high-stress, high-cost disasters.

Peace of Mind Is the Real Value

Renters insurance isn’t flashy. You won’t brag about it. But when disaster strikes, it’s the difference between panic and stability. It lets you recover, move forward, and stay financially secure.

Whatever you rent — high-rise, duplex, or studio — your possessions matter. Protect them before disaster strikes.

Exploring Love and Responsibility Through Shakespeare

A Midsummer Night’s Dream by William Shakespeare playfully explores love, marriage, and societal expectations. It portrays marriage as limiting and challenging but ultimately rewarding.

Hermia defies her father Egeus to marry for love, showing her desire for autonomy over societal duty. Meanwhile, men like Demetrius often pursue relationships based on entitlement and social expectation rather than mutual affection.

The marriage of Theseus and Hippolyta reflects hierarchical power dynamics, highlighting that marriages sometimes involve control and possession rather than pure love. Shakespeare’s work demonstrates the tension between personal desire, societal norms, and responsibility — a theme as relevant now as in the Renaissance.

Summary for SEO & Readers

- Coverage: personal property, liability, additional living expenses

- Exclusions: floods, earthquakes, pests

- Average cost: $15–$25/month

- Benefits: peace of mind, lawsuit protection, global coverage

- Best practices: inventory belongings, compare policies yearly

InsureDirect.com – Your Home Protection Partner

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Keep your home safe and secure with complete protection from InsureDirect — because your home deserves nothing less than the best.