Keywords: life insurance premiums, term life insurance, whole life insurance, life insurance rates, factors affecting life insurance, how to lower life insurance cost, life insurance quote, insurance coverage

Introduction: Understanding How Life Insurance Premiums Work

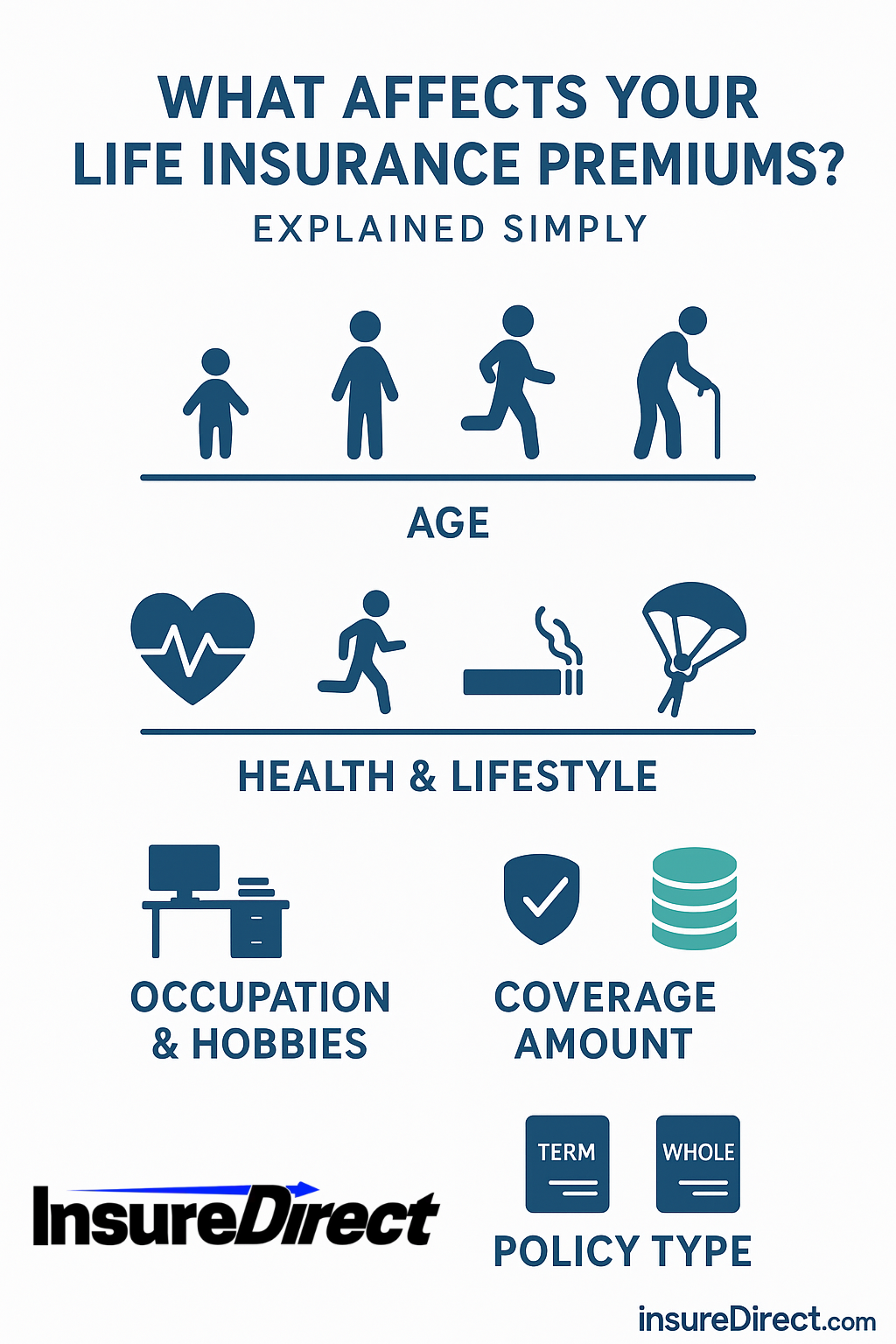

Have you ever noticed how two people can buy what looks like the same life insurance plan and yet pay very different prices? It’s not luck or favoritism — it’s math, risk, and a bit of science.

Your life insurance premium is what you pay to keep your coverage active. The amount isn’t random; it’s based on who you are, how you live, and the kind of protection you choose. In short, the lower the risk you appear to the insurer, the smaller the bill that lands in your mailbox.

This article breaks down, in simple everyday language, what truly affects your life insurance premium — and how you might lower it without losing valuable coverage.

1. What Is a Life Insurance Premium?

In plain words, your life insurance premium is the price tag for peace of mind. You pay it monthly, quarterly, or once a year — whichever option fits best.

In exchange, the insurance company promises a death benefit to your beneficiaries if you pass away while covered. Pretty straightforward, right?

However, everyone pays differently because every person brings a different level of risk. Insurers don’t guess — they calculate, using details like age, health, habits, and more to set your price.

2. The Key Factors That Affect Your Life Insurance Premiums

Insurance companies don’t roll dice. They use a process called underwriting — a detailed risk assessment that evaluates who you are and how likely you are to file a claim in the near future. Below are the biggest things that influence your life insurance cost.

A. Age – The Foundation of Your Premium

Let’s start with the most predictable one: your age. The younger you are when you buy life insurance, the cheaper it is — always.

Why? Because younger people are generally healthier and statistically less likely to pass away soon. As the years go by, risk increases, and so do premiums.

💡 Quick tip: If you’re thinking about getting coverage, don’t wait too long. Every year you delay, the price inches upward.

B. Health and Medical History

Health is one of the biggest deciding factors. Most insurance companies will ask for a medical exam, checking things like blood pressure, cholesterol, and overall fitness.

If you’re living with chronic issues like diabetes, heart problems, or obesity, your premiums could rise. Even your family medical history might impact your rate — genetics matter to insurers.

💬 Pro tip: Take care of yourself. Exercise, eat healthy, and schedule checkups. Better health not only makes life longer — it makes insurance cheaper, too.

C. Gender

Gender actually affects your insurance rate — though not in a way you control. Statistically, women tend to live longer than men. Because of that, women often pay lower premiums for the same coverage. It’s simply based on life expectancy data insurers rely on.

D. Occupation and Hobbies

Your job title might sound harmless, but to insurers, some professions are riskier than others. Firefighters, pilots, construction workers — they face more danger than office employees, so they pay higher premiums.

It’s not just about work. High-risk hobbies like skydiving, deep-sea diving, or mountain climbing can also bump up your rates.

✅ Tip: Always be upfront about what you do. Hiding a risky hobby could void your policy later, and that’s never worth it.

E. Smoking and Alcohol Use

If you’re a smoker, brace yourself — your life insurance will cost significantly more. Smoking drastically increases health risks, and insurers charge for that extra danger.

Heavy alcohol use can do the same. Occasional drinking? Usually fine. But regular overuse or past DUIs will raise a red flag.

🌿 Good news: Many insurers re-evaluate after 12 smoke-free months. Quitting could literally cut your premium in half.

F. Type and Amount of Coverage

Not all insurance is built alike. The type of policy and coverage amount you choose shape your premium.

Term Life Insurance is affordable and straightforward — it protects you for a set period (like 10, 20, or 30 years).

Whole Life Insurance, on the other hand, lasts forever and builds cash value over time, which makes it pricier but more flexible.

The higher the coverage, the higher the cost — but it’s about finding balance, not cutting corners.

💡 Tip: Use a coverage calculator to estimate what your family would actually need instead of guessing.

G. Lifestyle and Driving Record

Believe it or not, your driving habits can also affect your premiums. A clean record helps; a string of speeding tickets or accidents can raise costs quickly.

Insurers also look at your general lifestyle — fitness level, diet, stress management, and whether you engage in dangerous behavior. The healthier and safer your habits, the more affordable your policy becomes.

H. Your Location

Where you live plays a smaller, but still real, role. Areas with higher accident rates or environmental risks can lead to higher premiums. Similarly, states or regions with longer life expectancies might offer better rates overall.

3. Term vs. Whole Life Insurance: What’s the Difference in Premiums?

The type of life insurance you choose has a huge impact on what you pay.

Term Life Insurance is simple and affordable. It covers you for a specific time frame — say, 20 years. Once the term ends, the coverage stops unless you renew or buy another plan.

Whole Life Insurance provides lifelong protection and includes a cash value component, which grows as you pay premiums. Because of that savings feature, it’s more expensive upfront but offers more long-term flexibility.

It’s not about which is “better” — it’s about what fits your life and financial goals.

4. Smart Ways to Lower Your Life Insurance Premium

You can’t change your age or gender, but you can influence many other factors. Try these steps to bring your costs down:

Apply early. The younger, the cheaper.

Stay healthy. Exercise regularly, eat smart, and manage stress.

Quit smoking. It’s one of the biggest money-savers in insurance.

Compare quotes. Each insurer uses different pricing formulas.

Pick term insurance. It’s cheaper and often fits most needs.

Pay annually. Many insurers give a small discount for one-time yearly payments.

Little improvements over time can create huge differences in long-term costs.

5. Why Life Insurance Is Always Worth It

Life insurance isn’t just a bill — it’s a safety net. It ensures your loved ones aren’t left struggling with debts, funeral costs, or lost income if something happens to you.

It gives peace of mind, knowing your family will stay financially stable even in hard times.

Whether it’s term or whole life, insurance is really about love — protecting the people who depend on you.

Conclusion: Start Early, Stay Covered

Your life insurance premium reflects your lifestyle, health, and future risks — but the sooner you take action, the more control you have.

Start now. Compare quotes, live healthy, and find the right balance between protection and affordability. Because when it comes to securing your family’s future, waiting rarely helps — acting early always does.

Contact Information

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

📧 Email: contact@insuredirect.com

📞 Phone: (800) 807-0762 ext. 602

Keep your home safe and secure with complete protection from InsureDirect — because your home deserves nothing less than the best.