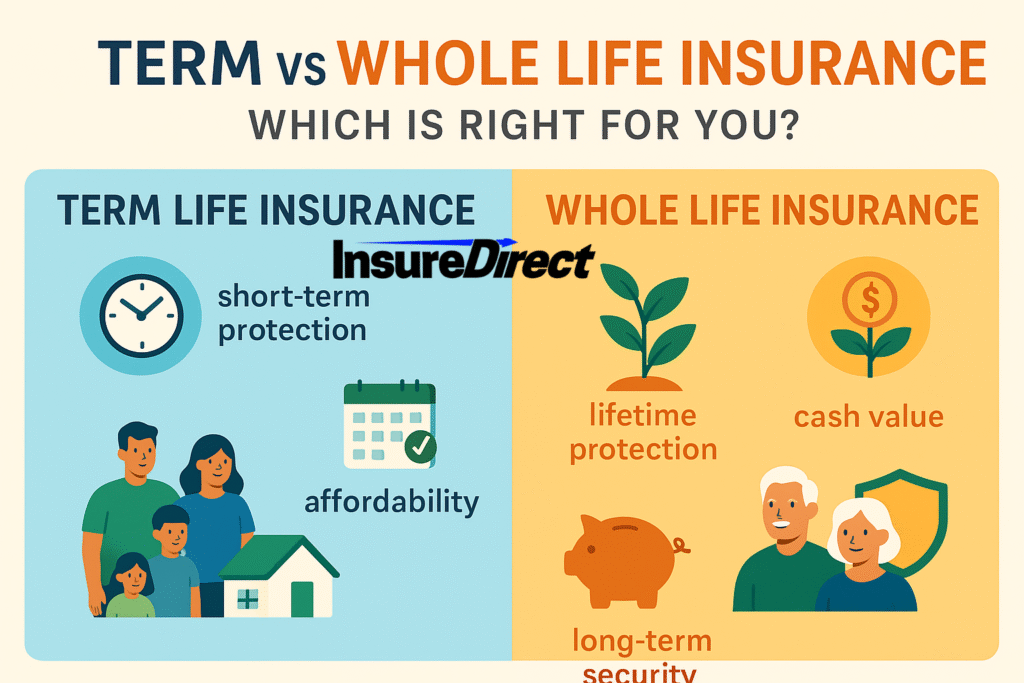

Life insurance? Confusing sometimes, but crucial. Term, whole life, oh my! Some people need temporary coverage, others want protection forever. Choosing wrong can hurt financially.

Term Life Insurance – Quick Coverage

Term life insurance gives protection for a set period—10, 20, or 30 years maybe. If you pass during the term, your beneficiaries get a payout. If not? Nothing happens.

Cheap, especially if you’re young.

Duration fixed; ends eventually.

Death benefit only, no savings or cash value.

Example: You’re 30, buy a 20-year term. Mortgage safe, kids covered. After 20 years, reevaluate or pay more.

Whole Life Insurance – Lifelong Security

Whole life insurance lasts for your whole life, as long as premiums are paid. Cash value grows slowly, premiums mostly fixed. But expensive—often much higher than term.

Lifetime coverage, no expiration.

Cash value accumulation, like a forced savings account.

Predictable premiums.

Costly; requires budget planning.

Example: Buy at 30. Covered forever. Cash value exists. Growth slow, but security guaranteed.

Term vs Whole Life – Main Differences

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed (10–30 years) | Lifetime, no expiration |

| Premiums | Lower, affordable | Higher, consistent |

| Cash Value | None | Accumulates over time |

| Flexibility | Sometimes convertible | Limited flexibility |

| Ideal For | Short-term obligations | Long-term security & investment |

Pros & Cons of Term Life

Pros:

Affordable for young adults or families.

Easy to understand, no complexity.

Matches temporary obligations like mortgages or tuition.

Cons:

Ends eventually; renewal costs often high.

No cash value; cannot borrow or save.

Premiums increase if renewed after term expires.

Pros & Cons of Whole Life

Pros:

Lifetime coverage ensures protection for life.

Cash value grows slowly; usable for emergencies or savings.

Premiums stable over time.

Cons:

High cost.

More complex than term; fine print matters.

Cash value grows slowly compared to other investments.

Who Should Choose Term Life?

Best for:

Parents with children.

Homeowners with mortgages.

People needing affordable short-term coverage.

Keywords: affordable term life insurance, term life benefits, best term life policies

Who Should Choose Whole Life?

Best for:

People seeking lifelong coverage.

Those interested in cash value accumulation.

Able to afford higher premiums comfortably.

Keywords: whole life insurance advantages, permanent life insurance, life insurance with cash value

Factors to Consider

Before choosing term vs whole life:

Budget: cheap now vs expensive now but lifetime coverage.

Financial goals: temporary protection or lifelong security?

Dependents: who relies on your policy?

Investment potential: cash value grows slowly.

Age & health: young and healthy = lower premiums.

Combining Term and Whole Life

Hybrid approach works. Term for temporary coverage, whole life for lifelong protection. Cost-effective, balanced.

Example: 30-year-old buys 20-year term for mortgage + small whole life for lifetime security. Coverage balanced.

Keywords: hybrid life insurance, combination policies, term + whole life

Conclusion

Term or whole life? Depends on goals:

Term life: affordable, short-term needs.

Whole life: lifelong coverage, cash value, legacy planning.

Hybrid: best of both worlds.

Choose carefully; family’s financial security depends on it.

Contact InsureDirect

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Keep your home safe and secure with complete protection from InsureDirect—because your home deserves nothing less than the best.