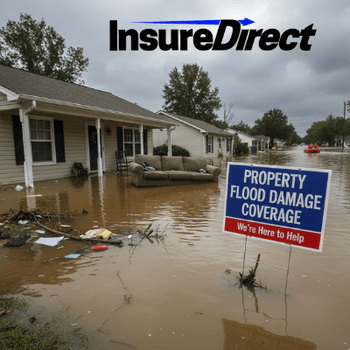

Floods. They’re stealthy. One second, life is good—your basement smells faintly of stale carpet—and the next? Water is seeping in like it owns the place. Drywall soggy, carpet sticking to your shoes, electrical outlets quietly mocking you—yep, that’s a flood. And your standard homeowners insurance? Nope. Doesn’t cover it. I learned that the hard way.

What “Flood Damage Coverage” Even Is

Let’s clear things up. Flood insurance isn’t for just any water mishap. Leaking pipes? That’s a separate claim. Flood coverage is for water coming from outside—rivers, lakes, stormwater runoff, snowmelt overflows—making its way into your home. Picture your backyard pond deciding it prefers to live in your living room. That’s flood insurance territory.

Many assume, “Oh, no river nearby, we’re safe.” FEMA statistics laugh at that logic. Around 20% of flood claims come from areas labeled “low” or “moderate” risk. Rising water doesn’t care about zoning maps.

Flood Costs Are Insane

One inch of water in your home? $20–25k in damage. I thought maybe $2k. Haha. Drywall, floorboards, rewiring electrical systems, furniture—all gone faster than my lunch when I forget it in the fridge.

Two Big Coverage Buckets

- The Structure – walls, foundation, wiring, furnace, water heater—the mechanical guts. Flood hits your drywall? This is what covers it.

- Contents – rugs, furniture, electronics, clothes, and even your washing machine. Both can be insured, but coverage limits differ. Choose wisely.

Things That Won’t Be Paid For

- Your car (auto insurance covers that).

- Cash, gold, jewelry (unless you bought extra coverage).

- Lawns, pools, fancy fountains.

- Mold from neglect—insurers aren’t babysitters.

Money, Premiums, and Deductibles

Premiums vary by flood zone and coverage level. My $800/year policy seems cheap compared to my friend’s $1,300 policy in a high-risk area. Deductibles are a gamble—high deductible, lower premium, but bigger bite when disaster strikes.

Start with FEMA and InsureDirect: $250k for structure, $100k for personal property. Need more? Private “excess flood” coverage is the way, but it takes effort to find.

Tools & Tips Before Buying Flood Insurance

- FEMA Flood Maps: free, online, easy to miss until it’s too late.

- Compare Policies: NFIP (government) vs. private insurers—don’t assume one is cheaper.

- Bundle Up: combining auto/home can save money.

- Preventive Measures: sump pumps, raised water heaters, flood barriers—small tweaks can reduce premiums.

When Floods Actually Happen

- Call your insurance company immediately. Don’t wait until the smell is unbearable.

- Document everything: photos, videos, timestamps—before cleaning. Every. Single. Item.

- Temporary repairs are fine: patch leaks, cover gaps—but save receipts.

- Patience is key: forms, inspections, waiting weeks. Mental fortitude matters.

Being covered was my financial safety net—I would have borrowed otherwise.

Realizations I Did Not Expect

- Location Doesn’t Guarantee Safety: low-risk areas flood too.

- Even Small Floods Destroy: a little water = a lot of damage.

- Insurers Read Fine Print: literally, they will.

Broader Insights: Flood Hazard Deep Dive

Flood Types Are Diverse

- Flash Floods: sudden, furious, from intense storms. Evacuate fast.

- River Floods: slower, sometimes predictable, but basements take the hit first.

- Coastal Storm Surges: hurricanes, tropical storms, enormous waves crashing in.

Know which type threatens your region to pick the right policy.

Flood Risk ≠ Proximity

Rivers aren’t the only concern. City streets, poor drainage, neighboring buildings, or ice jams can let water in. FEMA maps are helpful but incomplete.

Mold, Mildew, and Secondary Damage

Water isn’t the only cost—time matters. Mold spreads fast, mildew ruins furniture, and electrical hazards spike. Late claims or preventable damage? No coverage.

Structural Reinforcement Can Save Money

- Sump Pumps: cheap, lifesaving, modest premium reduction.

- Flood Barriers/Doors: keep water out.

- Elevated Appliances: water heater, washer, furnace—less risk, lower premiums.

Small prep = big long-term savings.

Choosing Your Policy

- Coverage Limits: know what you need vs. “standard maxes.”

- Excess Flood Insurance: valuable for expensive homes or high-value contents.

- Deductible Strategy: high = lower premium, bigger claim headache; low = higher premium, smaller claim.

- Private vs Government: NFIP is based; private fills gaps, offers flexibility, and faster claim payments.

The Claim Process – A Survival Guide

- Documentation: photos, video, itemized lists, timestamps.

- Communication: call early, be firm but polite.

- Temporary Fixes: patch leaks, dry carpets, keep receipts.

- Adjuster Meetings: know your limits, stay calm, ask questions.

- Payment Waiting Game: weeks are normal. Toughen up.

Miscellaneous Learnings

- Community Awareness: neighbors may minimize risk. Sharing facts helps.

- Seasonal Prep: hurricane season, spring snowmelt—be ready.

- Documentation Habit: photograph belongings even before a flood. Proof = peace of mind.

My Takeaway

Floods are unstoppable forces of destruction. Standard home insurance won’t help. Property flood coverage is boring, expensive, and full of fine print—but without it? Financial disaster is almost certain.

I’d buy flood insurance again, every single time. It’s more than protection—it’s peace of mind.

Getting Coverage

InsureDirect Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Protect your home, protect your sanity. Flood insurance isn’t glamorous. But it’s life-saving.