Selecting insurance can be difficult. E&O? Liability for Professionals? Are they two sides of the same coin, cousins, or twins? Many experts, consultants, and business owners find it difficult to distinguish between the two. This is your 2025 breakdown, complete with all the information you require but twisted in style.

What Is E&O Insurance?

E&O insurance, often known as errors and omissions insurance, guards against errors in your professional services. The “oops” moments, you know. If someone files a lawsuit, a mistaken estimate, a missed deadline, or poor advice could cost thousands of dollars. Legal bills, settlements, and occasionally reputational harm are covered by E&O.

Consider it a safety net. Financially, the net catches you even as you slip and fall. E&O is frequently non-negotiable for consultants, IT specialists, real estate brokers, and other service providers. Without it, your company could be destroyed by a single lawsuit.

Key takeaway: E&O equals error protection. Easy.

Does Professional Liability Differ?

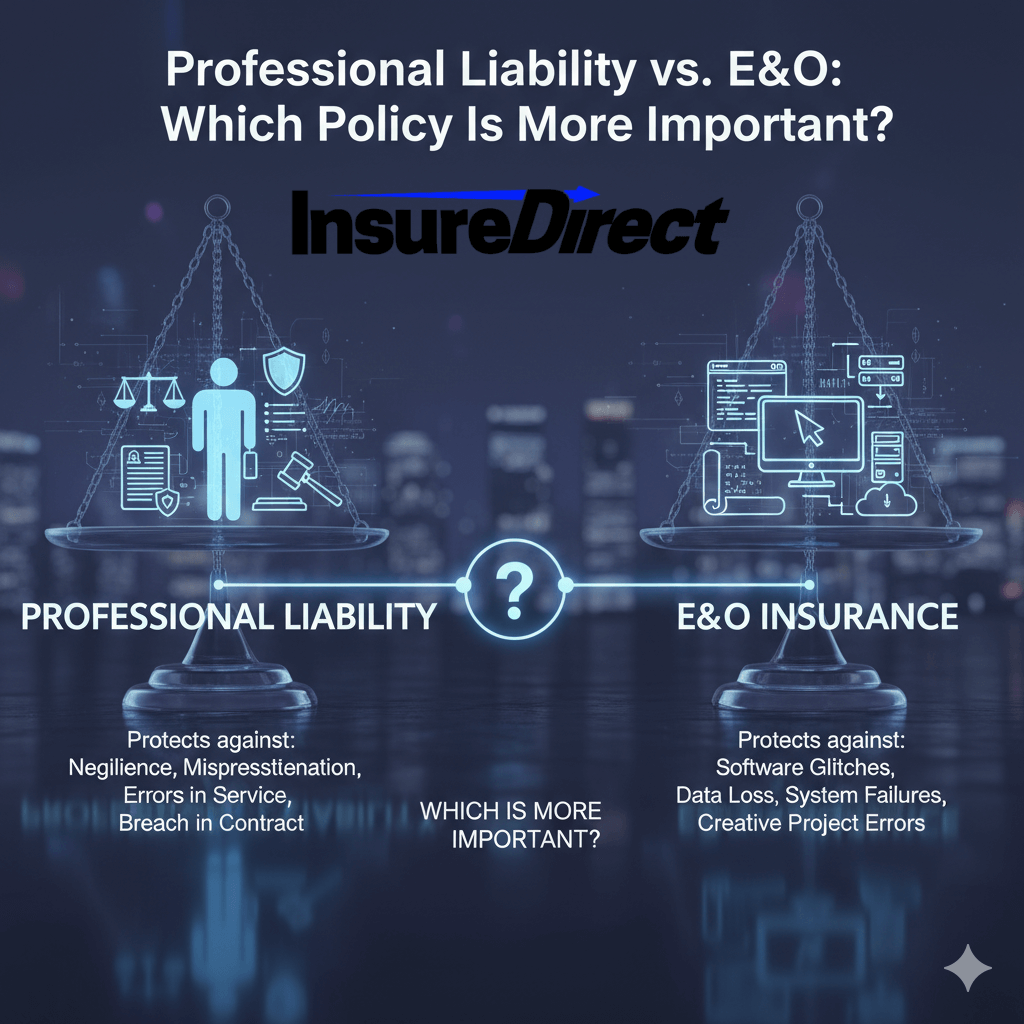

Indeed. And no. Although E&O and professional liability insurance are frequently used interchangeably, there are some minor differences. Errors and omissions in service delivery are covered by E&O, but professional liability can cover more ground, sometimes including contract violations, misrepresentations, and failure to fulfill obligations.

Assume the role of a financial advisor. Your guidance causes significant losses for your clients. The “bad advice” portion may be covered by E&O. Claims such as carelessness or breach of fiduciary obligation may fall under the purview of professional liability.

Brief comparison:

- E&O → Errors or failures.

- Professional Liability → Errors plus more general professional risks.

Why Are People Confused by the Terms?

Insurance technical terms. That’s the quick response. The phrases are frequently used interchangeably by carriers. Nuances are often not made clear in marketing materials. Additionally, regulations might occasionally be defined differently by state laws.

For example, because California authorities demand comprehensive coverage, an E&O policy may be titled “Professional Liability” for a real estate agent in the state. An IT consultant in Texas, meanwhile, would notice a well-defined E&O policy with explicit restrictions.

Yes, it is confusing. However, being aware of little variations can save hundreds—or even thousands—of dollars.

Which Professionals Usually Require E&O Insurance?

Many service providers. Consider:

- Software developers and IT consultants

- Brokers and agents in real estate

- Financial planners and accountants

- Attorneys and legal consultants (sometimes a more specialized form)

- PR and marketing firms

Note: Freelancers and small enterprises alike gain from this. A minor disagreement over a contract could result in an expensive lawsuit.

When Professional Liability Is Necessary

Professional liability shines when claims go beyond ordinary mistakes. For instance:

- Claims of negligence that aren’t obviously incorrect

- Accusations of breach of contract

- False representation in commercial transactions

Certain policies combine professional liability and E&O into a single “all-in-one” policy. However, always read the fine print because exclusions can be deceptive, coverage might vary, and some claims may be overlooked.

Pro tip: Professional liability is practically required if your company manages sensitive client assets.

Comparing Professional Liability and E&O Coverage

| Focus | Service errors or omissions | Mistakes plus additional professional hazards |

| Typical Users | Advisors, consultants, agents | Attorneys, medical consultants, financial advisors |

| Coverage | Settlements and legal fees | Settlements, legal costs, and broader claims like negligence or violations |

| Exclusions | Often narrower | Can vary greatly, sometimes broader |

Take note of how minor variations count. Your “covered mistake” could be abruptly excluded with just one incorrect policy.

Costs: Essential Information

Revenue, risk exposure, and profession all affect pricing. The annual cost of an E&O policy for small firms could range from $500 to $3,000. Because of its wider coverage, professional liability insurance frequently costs between $1,000 and $5,000 annually.

Tips:

- Bundling insurance might occasionally result in lower premiums.

- Cheaper isn’t always better. Coverage gaps can be disastrous.

Real-World Examples

Example 1: A client’s system is not updated by a software developer. Data is lost by the client. Legal defense and settlement are covered by E&O.

Example 2: A sophisticated investment recommendation from a financial expert results in a significant loss. A client files a negligence lawsuit. Depending on the wording of the policy, Professional Liability may cover this.

Moral: Recognize your precise dangers. Rarely does one-size-fits-all work.

How to Determine Which Policy Is Necessary

- Evaluate Your Risk Exposure – What errors are likely, and what claims might be made?

- Examine Client Contracts – Proof of professional liability or E&O coverage is required by some clients.

- Compare Policies – Coverage limits, exclusions, legal assistance, and claims management.

- Speak with a Broker or Agent – They can explain the small variations in your state.

Pro tip: Update the terms of your policy and coverage annually. Laws and industry standards change frequently.

SEO Advice for Insurance Companies

While on topic:

- Keywords: professional liability coverage, business insurance comparison, errors and omissions insurance, E&O vs. professional liability 2025

- Headers: Use H2s for major topics, H3s for subpoints. Google prefers a clear structure.

- Internal linking: Link to other insurance articles to boost authority and dwell time.

- FAQ sections: Google likes structured Q&A, e.g., “Is negligence covered by E&O?”

A small grammar hint: Occasional sentence fragments can improve readability.

Common Misconceptions

- “They are identical.” Not always true—coverage nuances matter.

- “E&O covers everything.” False—exclusions exist. Always read the policy.

- “I’m too small to need it.” Even freelancers can face million-dollar lawsuits.

Remember: Lawsuits do not discriminate based on business size.

Deductibles and Policy Limits

Higher limits = more coverage and higher premiums. Typical small business E&O limits: $1M per claim / $2M aggregate. Professional Liability can go higher depending on the profession, especially in legal, medical, or financial fields.

Deductibles: $500–$2,500 per claim. Higher deductibles reduce premiums but increase out-of-pocket risk.

Does Bundling Make Sense?

Many insurance companies provide professional liability and E&O coverage together.

Benefits:

- Single premium and simpler billing.

- Broader coverage.

- Easier claims processing.

Drawbacks:

- May cover unnecessary items.

- Fine print can hide exclusions.

Advice: Compare individual policies before combining.

Conclusion: Which Policy Is Best for You?

- E&O: If your work is primarily advisory/service-based, mistakes are the main risk.

- Professional Liability: If your job involves high-stakes decisions or broader professional duties.

- When in doubt: Consult an insurance broker familiar with your industry.

Coverage is more than a formality—it’s a financial safety net, stress reducer, and sanity saver.

FAQs (SEO Bonus)

Q1: Can I have both Professional Liability and E&O?

A1: Yes. Some companies choose both or find a combined all-in-one policy.

A1: Yes. Some companies choose both or find a combined all-in-one policy.

Q2: Does E&O cover intentional misconduct?

A2: No. Intentional acts, fraud, or illegal actions are typically excluded.

A2: No. Intentional acts, fraud, or illegal actions are typically excluded.

Q3: How much does a small business E&O policy cost?

A3: Typically $500–$3,000 per year, depending on revenue, risk, and profession.

A3: Typically $500–$3,000 per year, depending on revenue, risk, and profession.

Q4: What’s the difference between general liability and E&O?

A4: General liability covers bodily injury/property damage, not professional errors. E&O focuses on mistakes in professional services.

A4: General liability covers bodily injury/property damage, not professional errors. E&O focuses on mistakes in professional services.

Keywords for SEO: E&O insurance, professional liability coverage, business insurance 2025, errors and omissions vs. professional liability

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602