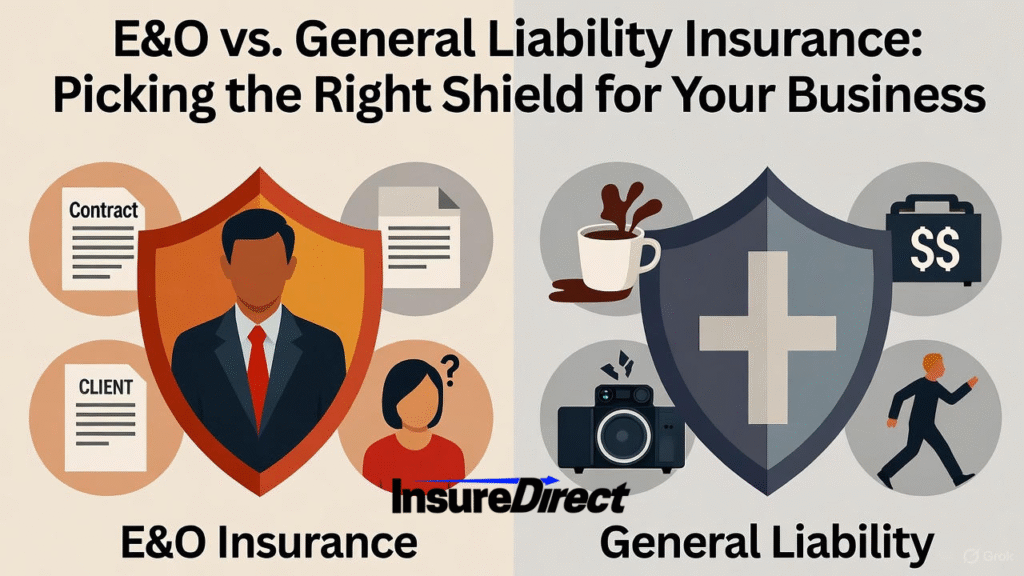

Business, whether you adore it or despise it, is a battlefield of risks. Insurance? Think of it as your armor. But which one? Errors & Omissions (E&O) or General Liability? Many assume they are identical. Nope—not even remotely. And picking the wrong one might cost far more than anticipated.

General Liability Insurance: What’s It Really?

General Liability Insurance—consider it the classic blanket of business protection. Trips in your office, accidental damage to a client’s property, advertising missteps—it all falls here. But, slip up on a financial report or give the wrong advice? That’s another story entirely.

The Tangible Risks You Can Actually See

Businesses handling physical property—retail shops, warehouses, office spaces—this is your go-to. Imagine a customer trips over an exposed cable, breaks a wrist, and suddenly hospital bills plus legal fees are piling up. Without General Liability, covering it could mean liquidating equipment or assets.

E&O Insurance: The Invisible Safety Net

Errors and Omissions (E&O), sometimes called Professional Liability, is less visible but equally essential. Consulting, planning projects, offering advice—one small misstep, one overlooked detail, and your client could suffer financial loss. E&O swoops in when General Liability stays silent.

For Service-Oriented Professionals

Consultants, IT specialists, accountants, lawyers, freelancers—anyone whose work is intellectual or advice-based—listen closely. Mess up financially or strategically, and E&O has your back. General Liability? Not even close.

Scenario: You are a marketing consultant; your recommendation causes a $20,000 loss. E&O handles defense and settlement.

Scenario: You own a retail store; a customer trips and falls. General Liability covers medical and legal fees.

Brains vs. bodies—it’s that simple.

Tangible vs. Professional Risks: Understanding the Gap

| Coverage Type | General Liability | E&O Insurance |

|---|---|---|

| Covers | Physical injuries, property damage, advertising mishaps | Professional mistakes, negligence, service errors |

| Ideal For | Shops, contractors, restaurants | Consultants, lawyers, accountants, IT firms |

| Example | Client trips in your store | Incorrect advice causes financial loss |

| Type | Tangible, visible | Intangible, service-based |

Which Protects Better? Depends on Your Business

The million-dollar question. Really depends on whether your business is product-oriented, advice-based, or a hybrid.

Service-Based: Advice or specialized service is your main product. Financial loss is the exposure. E&O is essential.

Product-Based / Physical: Physical products or locations present risks like slips, falls, or property damage. General Liability is critical.

Hybrid: Do both? Then both policies become essential—no shortcuts.

Hybrid Businesses: Balancing Risks

Some businesses straddle both domains. Real estate agents, for instance, deal with client visits (trip hazards) and professional advice (financial risk). Marketing agencies may host photoshoots (property damage) and handle campaign strategy (mistakes). Without dual coverage, a single lawsuit could wipe out years of revenue.

Real-Life Examples

Example 1: The Slip

A photography studio. Client trips over equipment, breaks a wrist. Legal bills soar. General Liability covers it. E&O? Irrelevant here.

Example 2: The Error

Financial consultant miscalculates taxes. Client suffers a loss. E&O handles it. General Liability doesn’t touch financial mistakes.

Why You Might Need Both

Choosing just one coverage isn’t enough for most modern businesses.

Complete Protection: Physical injuries + professional mistakes = total peace of mind.

Client Requirements: Many contracts require both coverages.

Defense Costs: Lawsuits are expensive, even when you’re not at fault.

Tip: Bundling both policies often reduces cost and simplifies administration.

Budgeting for Protection

Money matters. Typical small business costs:

| Type | Average Annual Cost |

|---|---|

| General Liability | $400–$800 |

| E&O Insurance | $500–$1,500 |

Yes, E&O is pricier, but a single professional mistake can cost $50,000–$100,000 or more. Perspective, right?

Common Misconceptions

“General Liability covers everything” → Nope, only tangible stuff.

“E&O is for big firms only” → Not true; small businesses and freelancers are vulnerable.

“Insurance won’t cover legal defense fees” → Most often, it does.

“If clients sign contracts, I don’t need E&O” → Contracts reduce risk, but lawsuits can still happen.

Modern Risks: Cyber Liability and Beyond

Today, businesses face digital threats too. Software bugs, data breaches, privacy violations—these risks grow every year. Certain E&O policies extend coverage to tech errors.

Scenario: You develop software; a bug causes a client loss. E&O covers it.

Scenario: A hack exposes client data. Some policies cover notification costs and legal defense.

Ignoring these emerging threats is like ignoring a shark in the swimming pool—you may regret it.

Industry-Specific Coverage Considerations

Lawyers / Accountants: E&O is critical; General Liability optional unless office visits are routine.

IT Professionals: E&O essential; General Liability useful for onsite installations.

Contractors / Retail Shops: General Liability is vital; E&O less relevant unless advising clients on technical or financial matters.

Freelancers / Designers: E&O protects advice and creative work; General Liability covers in-person meetings.

Choosing the Right Insurer

Insurance isn’t one-size-fits-all. Compare carefully.

Review the insurer’s claims history and financial stability.

Ask about bundled options like Business Owner’s Policies.

Examine coverage limits and exclusions.

Read fine print—some policies exclude specific services.

A poorly chosen insurer could leave gaps bigger than a sinkhole.

Tips for Smarter Coverage

Risk Assessment: List all potential financial and physical exposures.

Annual Review: Business changes; so should coverage.

Consult Professionals: Brokers can identify gaps you might overlook.

Excess/Umbrella Policies: Provides extra protection beyond standard coverage limits.

Employee Training: Staff errors cause many claims—prevention is cheaper than litigation.

Conclusion: Protect Your Business Wisely

E&O vs. General Liability? Know your risks before deciding.

E&O: Protects intellectual and professional output (advice, services, strategy).

General Liability: Protects tangible interactions (property, customers, employees).

Hybrid Businesses: Need both for comprehensive peace of mind.

Insurance is not just a cost—it’s a strategic investment. A single lawsuit could destroy years of effort. Protect wisely, plan ahead, sleep easier.

SEO Keywords Included

Errors and Omissions Insurance, E&O Insurance, General Liability Insurance, professional liability, business insurance coverage, small business insurance, hybrid business insurance, liability protection, commercial insurance, financial risk insurance, professional risk coverage

Contact InsureDirect

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Keep your home safe and secure with complete protection from InsureDirect—because your home deserves nothing less than the best.