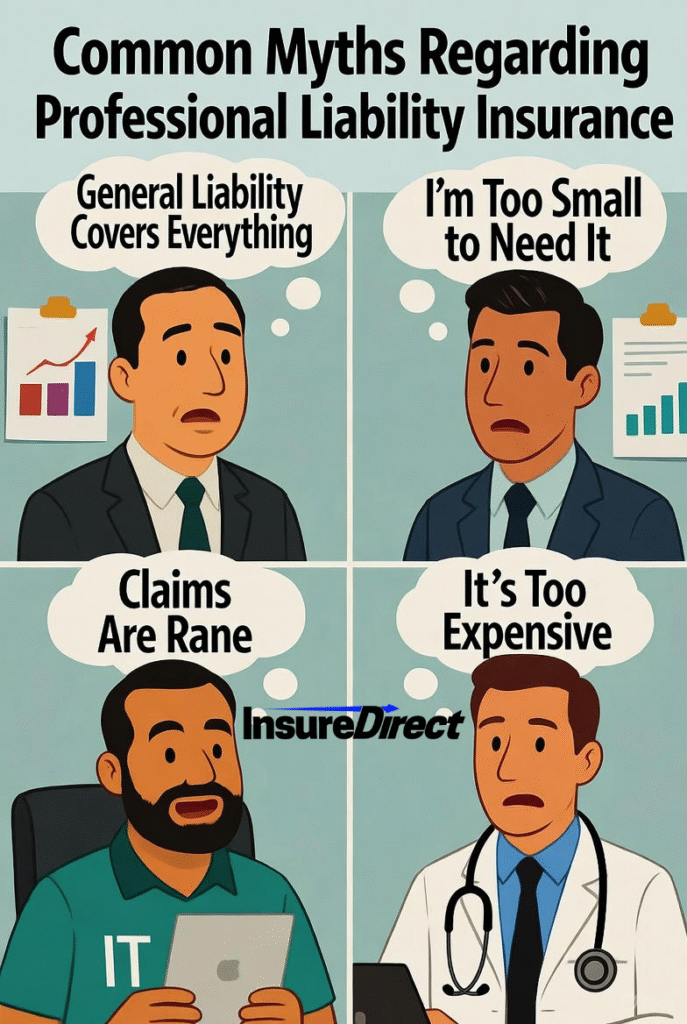

Nearly all Texans believe they understand professional liability insurance — but assumptions can be expensive. Below are some myths commonly accepted by professionals in Dallas, Houston, and Austin:

Myth 1: “My General Liability Insurance Covers Everything”

False. General liability only covers property damage, slip-and-fall incidents, or physical injury. Errors in your professional services? No coverage. For instance, if a software consultant mistakenly deletes a client’s database, general liability won’t cover the resulting financial loss.

Myth 2: “I Work Alone, So I Don’t Need It”

Solo practitioners often think they’re invincible. An unhappy client can still file a lawsuit. Even freelancers can face claims that drain savings.

Myth 3: “E&O Insurance Covers Intentional Acts”

Intentional acts, criminal acts, and fraud are specifically excluded. Insurance protects honest mistakes, not criminal behavior.

Myth 4: “Cyber Risks Are Automatically Covered”

Most standard E&O policies do not cover data breaches. Professionals handling sensitive client information should consider a stand-alone cyber liability policy.

Malpractice Insurance for Healthcare Professionals

Texas healthcare professionals face unique risks. Misdiagnoses, medication errors, therapy mistakes, or communication errors can result in lawsuits. Malpractice insurance, a type of professional liability coverage, shields healthcare professionals from these costly claims.

Real Texas Examples

- Houston therapist: A patient’s condition worsened after incorrect advice. Coverage helped pay the $20,000 legal fee.

- Dallas nurse practitioner: Miscommunicated medication directions caused patient harm. E&O insurance resolved the claim and preserved the practice.

- Austin chiropractor: A routine adjustment accidentally caused injury. Insurance covered legal expenses and potential settlements.

Without insurance, even a single mistake could financially ruin a medical practice. InsureDirect offers bespoke Texas malpractice insurance to provide the right protection for specialized practice risks.

Selecting an Appropriate Professional Liability Insurance Provider in Texas

Purchasing a policy involves more than price. Aligning coverage with your industry, location, and client risk exposure is critical. InsureDirect provides:

- Industry-specific coverage: Architects face different exposures than IT consultants or accountants.

- Geography-specific options: Texas’s diverse markets — from Houston downtown business areas to West Texas oil fields — require customized coverage.

- Multiple carriers: Compare quotes and coverage easily.

- Clear policy explanations: Understand deductibles, exclusions, and coverage limits.

- Quick claims coordination: Minimize business interruption if a claim occurs.

Understanding Policy Limits and Exclusions

Policy terms can be confusing. Understanding them prevents unpleasant surprises:

- Per-Occurrence Limit: Maximum payout per claim. A $100,000 limit doesn’t mean full protection if the claim exceeds this amount.

- Aggregate Limit: Maximum payout during the policy period, usually annually.

- Deductibles: Your upfront cost before insurance pays.

- Exclusions: Specific situations not covered. Reading the fine print is essential.

Example: An Austin IT consultant accidentally deleted client files. Insurance covered $15,000 in legal costs, but the claim approached the per-occurrence limit — highlighting the importance of knowing your limits.

Texas Case Studies: Professional Liability in Action

The Austin IT Consultant

A software update wiped out client documents. Without coverage, the business could have failed. With E&O coverage from InsureDirect, over $15,000 in legal fees and damages were paid.

The Dallas Architect

Structural miscalculations delayed a construction project. E&O insurance handled the claim, preserving reputation and finances.

The Houston Financial Advisor

A tax filing error led to an IRS penalty and client dispute. Insurance protected both the advisor’s business and reputation.

These scenarios show that even the most diligent professional can face unexpected claims, proving why insurance is essential.

Practical Advice for Texas Professionals

1. Evaluate Risk Honestly

Consider your industry, clients, and experience. Errors in financial planning, software, or healthcare can be extremely costly.

2. Shop Around

Coverage and premiums vary. InsureDirect provides access to multiple carriers to find policies matching both budget and risk.

3. Review Policies Annually

Business changes, and so should your coverage. Expanding services or taking on new clients may require adjusted limits.

4. Bundle When Possible

Combine professional liability with general liability, cyber insurance, or workers’ compensation for simplified management and potential savings.

5. Document Everything

Maintain detailed records of services, contracts, and communications. They’re invaluable if a claim arises.

Expanding Protection Beyond Standard Coverage

Professional liability is crucial, but additional risk management can include:

- Cyber Liability Insurance: Covers breaches, hacking, or ransomware attacks.

- Directors & Officers (D&O) Insurance: Protects executive decisions in corporate settings.

- Employment Practices Liability Insurance (EPLI): Covers employee claims of discrimination or wrongful termination.

- Umbrella Insurance: Extends coverage for catastrophic claims.

Bundling these policies with professional liability coverage offers a comprehensive safety net against diverse risks.

Local Considerations for Texas Professionals

Texas’ diversity means local factors affect coverage needs:

- Houston & Galveston: Weather-related issues can complicate service delivery.

- Dallas-Fort Worth: Dense business districts increase exposure to client lawsuits.

- Austin: Tech startups face intellectual property and software-related risks.

- West Texas: Energy sector regulations generate unique exposures.

InsureDirect’s local expertise ensures coverage is tailored to your city, industry, and business model.

Why InsureDirect Makes Professional Liability Insurance Easy

- Targeted, industry-specific protection

- Prompt claims resolution

- Clear policy limits and exclusions guidance

- Flexible payment options for small businesses and independent professionals

With InsureDirect, you don’t just get insurance — you gain a partner protecting your professional future.

Conclusion: Safeguard Your Professional Future

Professional liability insurance isn’t a magic solution, but it protects what matters most: errors, oversights, and common professional risks. With InsureDirect and Combined Insurance Group, Texas professionals gain:

- Protection from lawsuits impacting business and personal assets

- Peace of mind to focus on service delivery

- Industry-specific guidance

- Access to multiple carriers and policy bundles

Even the most diligent professional can face claims. Protecting your practice, reputation, and lifestyle is worth far more than a single policy.

Call to Action

Learn more about professional liability insurance in Texas:

- Phone: (800) 807-0762

- Email: contact@insuredirect.com

- Website: www.InsureDirect.com

Safeguard your Texas career today — peace of mind is priceless.