Unpredictability is a part of life. While some days seem ordinary, others remind us that tomorrow is never promised. Life insurance isn’t just a financial product; it’s a promise, a safety net, and a way to ensure your loved ones are protected even if you’re not there. But how exactly does it work? And why shouldn’t you delay getting coverage? Let’s explore.

Life Insurance: What Is It?

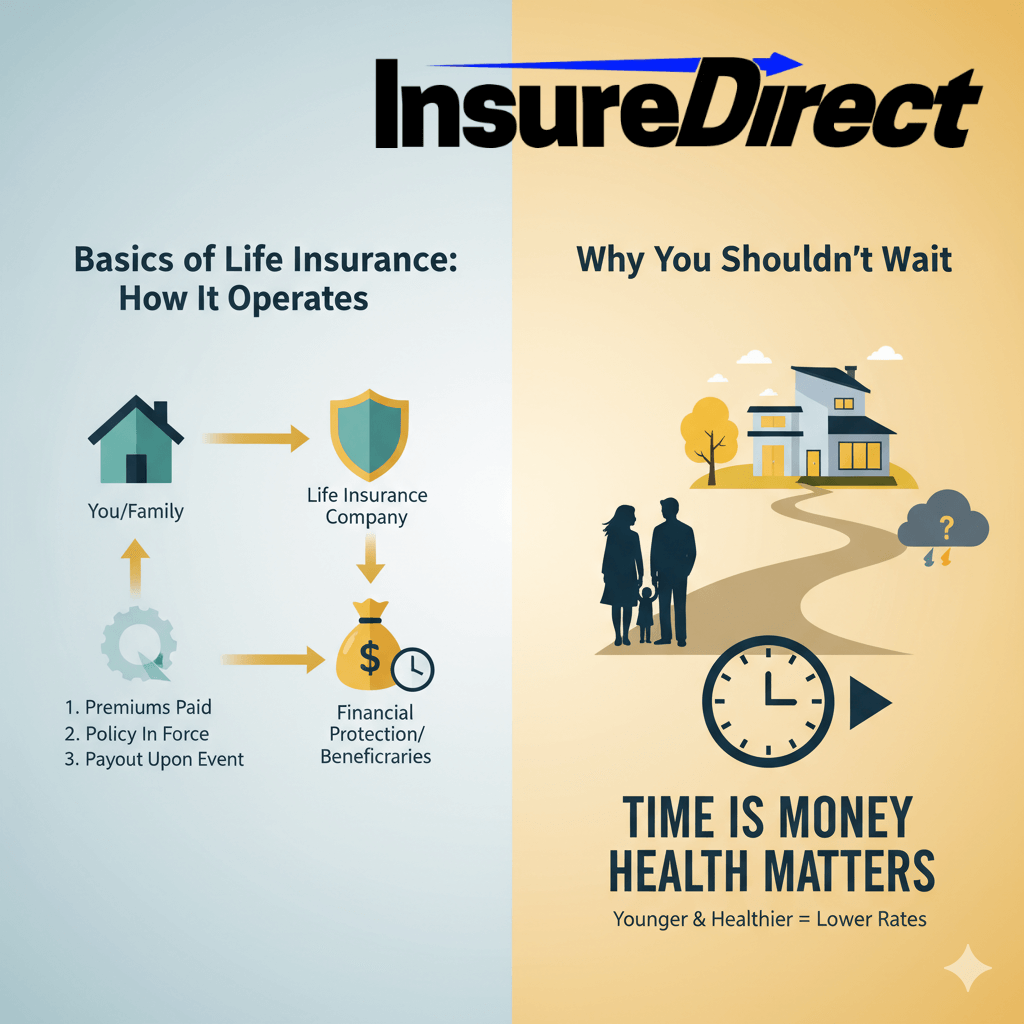

At its core, life insurance is an agreement between you and an insurance company. You pay regular premiums, and in return, the insurer guarantees a payout to your beneficiaries upon your death.

Imagine planting a tree today that will provide shade for your family when you cannot. Life insurance isn’t about enjoying rewards yourself—it’s about ensuring those you love can continue to live comfortably.

While some policies may accumulate cash value, the primary purpose of life insurance is protection. Many people mistakenly believe it is primarily a savings or investment tool.

How Life Insurance Operates

Even though the details may seem complicated at first, life insurance works in a straightforward manner:

- Choose a Policy Type – Term life, whole life, or universal life. Each has different features and costs.

- Calculate the Coverage Amount – How much would your family need if you weren’t there? Include bills, mortgages, education, and everyday living expenses.

- Pay Premiums – Monthly, quarterly, or annually. Missing payments can put your coverage at risk.

- Beneficiaries Receive the Death Benefit – Upon your passing, your loved ones receive the payout, often tax-free.

A little-known fact: premiums are lower when purchased at a younger age and when you’re healthy. Waiting often leads to higher costs and potential health-related exclusions.

Types of Life Insurance

There are several kinds of life insurance, and choosing the right one is critical.

1. Term Life Insurance

Term life is simple. You pay lower premiums and receive coverage for a fixed period—10, 20, or 30 years. If you pass away within the term, your beneficiaries receive the payout.

Pros: Affordable, easy to understand, great for specific needs like mortgages or children’s education.

Cons: Coverage ends when the term expires; no cash value accumulation.

Cons: Coverage ends when the term expires; no cash value accumulation.

2. Whole Life Insurance

Whole life insurance provides permanent coverage and includes a cash value component that grows over time.

Pros: Lifetime coverage, cash value that can be borrowed against.

Cons: Higher premiums, more complex.

Cons: Higher premiums, more complex.

3. Universal Life Insurance

Universal life is a flexible option offering permanent coverage with a savings component. You can adjust premiums and coverage amounts over time.

Pros: Flexibility, potential cash value growth.

Cons: Complexity, fees may reduce returns.

Cons: Complexity, fees may reduce returns.

Why You Shouldn’t Delay Buying Life Insurance

Life insurance is often postponed. “I’m too young” or “I’ll get it next year” are common excuses.

Here’s the reality: delaying can increase costs and leave your family exposed.

- Premiums Rise With Age: Waiting makes coverage more expensive.

- Health Changes Matter: Illness or conditions can make coverage harder to get or costlier.

- Financial Protection Gap: Without coverage, your family may struggle financially.

Even if you’re young, single, or financially stable, life insurance forms a foundation for long-term financial planning.

Benefits of Life Insurance

Life insurance provides more than just financial protection after death:

1. Family Protection

It ensures that your loved ones are financially safeguarded. Bills, mortgage payments, education costs, and daily living expenses are covered.

2. Peace of Mind

Life insurance removes uncertainty. You know your family won’t face financial turmoil if something unexpected occurs.

3. Debt Coverage

Credit cards, loans, or other debts can burden your survivors. Life insurance can pay these off.

4. Cash Value Growth

Certain policies (whole or universal life) build cash value over time, which can be used for retirement planning or borrowed against.

5. Estate Planning

Life insurance can assist with estate taxes or ensure assets are distributed according to your wishes.

How Much Life Insurance Do You Need?

Coverage needs vary per individual. Consider:

- Income Replacement: How many years of income should your family have?

- Debts and Loans: Mortgage, car loans, credit cards.

- Education Costs: College tuition, extracurriculars.

- Living Expenses: Daily costs of your household.

A common guideline is 10–15 times your annual income, but personalized calculations often work best.

Life Insurance for Young Adults and Families

If you’re in your 20s or 30s, life insurance may feel unnecessary. But buying early has key benefits:

- Lower Premiums: Young, healthy individuals get the best rates.

- Lock in Health: Later health issues can raise premiums or limit coverage.

- Financial Foundation: Start early to ensure long-term financial stability.

Families benefit by protecting children and spouses from financial hardship. Even single-parent households gain significantly.

Common Myths About Life Insurance

❌ “I’m too young to buy.”

Young adults secure the cheapest coverage and avoid future premium increases.

❌ “I don’t have dependents.”

Even single adults can use life insurance to cover debts, funeral expenses, or leave a legacy.

❌ “It’s too expensive.”

Term life insurance can be cheaper than your daily coffee budget.

❌ “Employer coverage is enough.”

Workplace group policies are often limited and not portable. Private coverage ensures continuous protection.

Life Insurance as Part of Financial Planning

Life insurance is not just protection—it’s a financial planning tool:

- Manages risk for your family.

- Integrates with retirement and savings strategies.

- Protects business owners or partners from unexpected losses.

- Ensures legacy planning for heirs or charities.

Smart financial planning often starts with assessing life insurance needs, then layering in other investments and accounts.

Tips for Choosing the Right Life Insurance

- Evaluate Your Needs – Determine coverage based on income, debts, and financial goals.

- Compare Quotes – Different insurers offer different premiums and benefits.

- Understand Policy Terms – Check fine print for exclusions or riders.

- Consider Riders – Disability, critical illness, or accelerated death benefits can enhance protection.

- Work with a Professional – Agents can tailor coverage for your specific situation.

Life Insurance: Why It Matters Now

Life is unpredictable, and the world can change in an instant. Accidents, illnesses, or financial crises can happen anytime. Life insurance provides a financial safety net and peace of mind for those who matter most.

Delaying coverage increases costs and leaves your family vulnerable. Even a small policy obtained early can secure your family’s financial future.

Conclusion: Don’t Delay Protecting Your Future

Life insurance is more than a policy; it’s a combination of family protection, financial planning, and peace of mind.

The longer you wait, the higher the costs and the greater the risk. Start today—even with a modest policy—and adjust coverage as your circumstances evolve.

Remember: The best time to purchase life insurance was yesterday. The next best time is now.

SEO Keywords Included

Life insurance basics • How life insurance works • Benefits of life insurance • Term life insurance • Whole life insurance • Universal life insurance • Why buy life insurance • Family protection • Financial planning • Young adults’ life insurance • Life insurance myths • Life insurance costs • Life insurance coverage

Contact Information

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

📧 Email: contact@insuredirect.com

📞 Phone: (800) 807-0762 ext. 602

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

📧 Email: contact@insuredirect.com

📞 Phone: (800) 807-0762 ext. 602