Sometimes, even the most experienced professionals slip up. No matter how careful you try to be, one little mistake can lead to a massive financial problem. Errors and Omissions (E&O) Insurance, also known as Professional Liability Insurance, helps protect your business when your professional services don’t go as planned.

If a client claims your advice, service, or decision caused them financial harm, E&O Insurance can save you from paying thousands out of pocket. Let’s understand what it really means, what it covers, and why it matters more today than ever before.

Specifically, What Is Errors and Omissions (E&O) Insurance?

E&O Insurance is like a safety net for professionals who give advice, perform services, or make judgments that impact others. It covers monetary losses if a client claims your work injured them financially.

To put it briefly, it has nothing to do with physical damage like fire or theft. It’s about mistakes in your work—the kind that can cost your clients money and you, your reputation.

E&O is sometimes assumed to be just for large corporations. That’s not true at all. Small businesses, independent contractors, consultants, brokers, and IT specialists can all be sued for an error they never even knew they made.

It’s best described as “protection from human imperfection.” Because, let’s be honest, even the best of us can miss a small detail now and then.

The Differences Between General Liability and E&O Insurance

E&O and General Liability Insurance are often confused, but they cover entirely different risks.

- General Liability Insurance covers physical injuries and property damage.

- Errors and Omissions Insurance covers professional mistakes, missed deadlines, or bad advice.

Imagine you’re a marketing expert who promised a campaign would boost revenue—but it didn’t. The client sues, claiming your poor strategy cost them thousands. E&O helps pay for legal defense and any potential settlements.

General Liability wouldn’t help in that case—it doesn’t cover professional or “intellectual” errors.

If you use your expertise, advice, or judgment to make a living, E&O is what keeps you out of serious financial trouble.

Who Actually Needs E&O Coverage?

The short answer? Anyone who offers advice or services where a mistake could cost a client money.

Here are some common examples:

1. Real Estate Agents

A missed disclosure about a property’s history can lead to a lawsuit faster than you’d think. E&O helps pay for your defense, even if you didn’t technically do anything wrong.

2. Insurance Agents and Brokers

Clients might say you didn’t explain coverage properly or forgot something in their policy. E&O protects your license, credibility, and finances.

3. Financial Advisors and Consultants

If your advice causes a client financial loss—or they believe it did—they could sue. E&O steps in to handle your defense costs.

4. IT Professionals

A single software glitch or a failed update can shut down an entire business. Claims like these can add up quickly, and E&O helps cover them.

5. Contractors and Designers

When a design error delays a project or costs the client extra money, E&O can step in to help manage the financial fallout.

Basically, if your work affects someone else’s finances, data, or business outcome, you need E&O insurance.

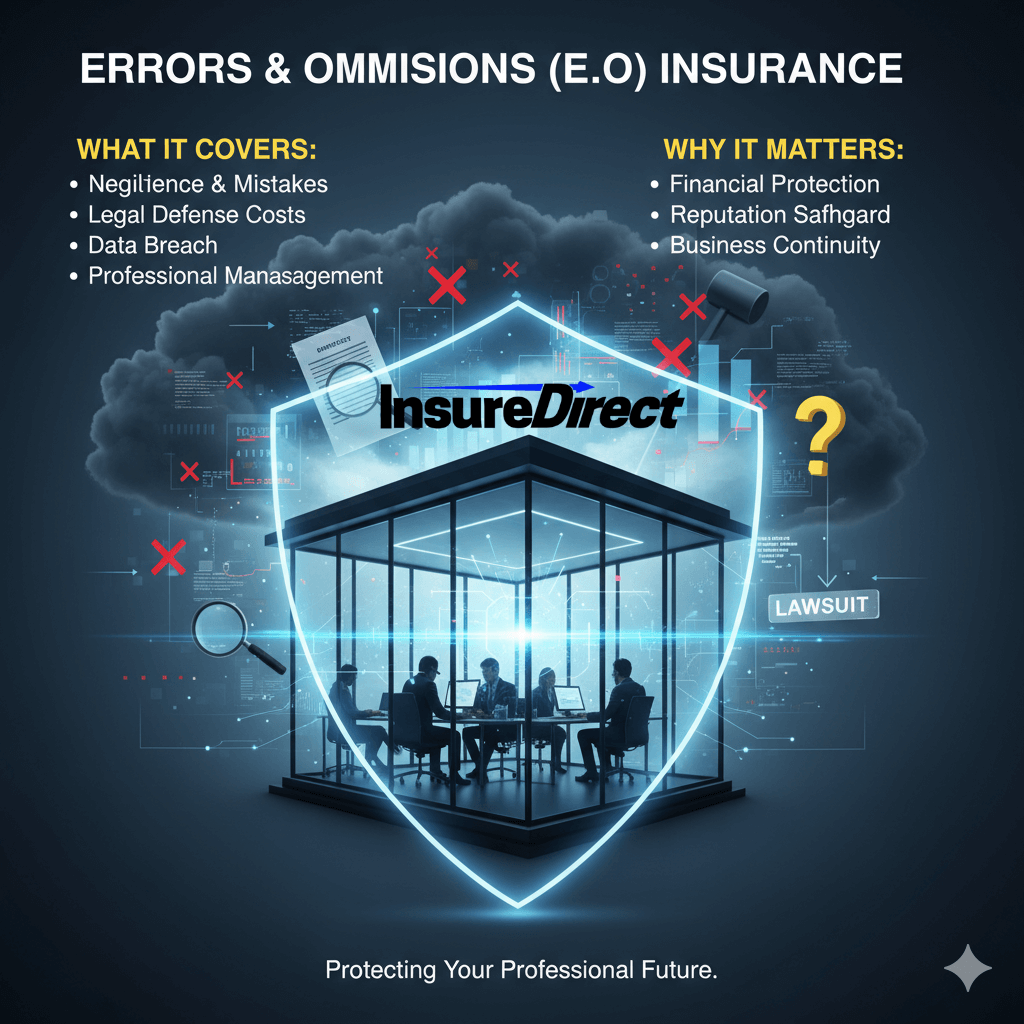

What Does E&O Insurance Actually Cover?

Now for the most important part—what does it really cover?

E&O Insurance typically includes the following protections:

E&O Insurance typically includes the following protections:

✅ Legal Defense Costs

Even if the claim isn’t true, you still have to appear in court. E&O covers attorney fees, court costs, and expert witness expenses.

✅ Settlements and Judgments

If you’re found liable (or choose to settle out of court), your E&O policy helps pay the agreed amount so you don’t have to dip into business or personal savings.

✅ Negligence or Mistakes

Human errors happen—maybe you missed a detail, sent a wrong file, or forgot to follow up. These small oversights are often covered.

✅ Misrepresentation

If a client alleges that your statements were misleading and caused them harm, E&O covers the legal process and potential damages.

✅ Failure to Deliver Services

Missed deadlines or incomplete services—common issues in every business—are also covered under E&O.

What E&O Insurance Doesn’t Cover

E&O Insurance doesn’t protect you from everything. Here’s what’s not typically covered:

- Fraud or intentional wrongdoing: If you intentionally mislead a client, you’re responsible.

- Property damage or bodily injury: Covered under General Liability Insurance, not E&O.

- Employment issues: Such as harassment or discrimination—those fall under Employment Practices Liability Insurance (EPLI).

- Cyberattacks or data breaches: You’d need Cyber Liability Insurance for that.

- Criminal acts: No insurer covers illegal activity.

Knowing these exclusions helps you understand exactly when to rely on E&O and when additional coverage might be needed.

The Significance of E&O Insurance Now More Than Ever

It’s easier than ever for clients to file lawsuits today. One unhappy customer, one miscommunication, and you could face thousands in legal bills—even if you did nothing wrong.

The scary truth? Defending yourself still costs money. That’s why E&O is so important—it helps cover those costs while safeguarding your reputation.

💡 Example:

You run a small consulting firm, and a client sues, claiming your advice caused them to lose $100,000. Without E&O, defending yourself could cost $25,000 or more in legal fees.

With E&O, nearly all of that (minus your deductible) could be covered.

With E&O, nearly all of that (minus your deductible) could be covered.

So instead of asking, “Is E&O worth it?” ask yourself, “Can I afford to go without it?”

What Is the Price of E&O Insurance?

The cost of E&O Insurance depends on your industry, company size, revenue, and risk exposure. Here’s a rough estimate:

- Freelancers and consultants: $400–$900 per year.

- Small businesses: $1,000–$3,000 per year.

- High-risk professions: $5,000 or more annually.

The bright side? E&O premiums are tax-deductible as a business expense. And when compared to the cost of a lawsuit, that premium feels small.

Ways to Reduce the Cost of E&O Insurance

You don’t need to overspend to stay protected. Here’s how to keep premiums low:

- Bundle your policies. Combine E&O with General Liability or a Business Owner’s Policy (BOP) for discounts.

- Use clear contracts. A well-written agreement reduces misunderstandings.

- Keep documentation. Save all communications and approvals.

- Train your team. Educated employees make fewer costly mistakes.

- Choose a higher deductible. This lowers your monthly premium—just ensure you can pay it if needed.

These steps can reduce long-term costs without reducing protection.

Frequently Held Myths About E&O Insurance

Let’s clear up some common misconceptions:

❌ “I’m too small to get sued.”

Small businesses are actually sued more often than large ones—clients assume you’ll settle quickly to avoid legal fees.

❌ “General Liability covers everything.”

Nope. General Liability doesn’t protect you from professional errors or advice-related claims. Only E&O does that.

❌ “I never make mistakes.”

That’s great—but you can still be accused of one. Defending against false claims is expensive.

❌ “E&O is too expensive.”

Compared to a single lawsuit, it’s actually affordable. One claim could destroy your finances and reputation.

Small Business E&O Insurance

For small businesses, E&O coverage is especially vital. Many small firms don’t have in-house legal teams or financial reserves to handle lawsuits. A single claim could end the business overnight.

E&O serves as a lifeline, allowing your company to keep operating while your insurer covers defense costs. It’s not just protection—it’s peace of mind.

Plus, many clients and vendors require proof of Professional Liability coverage before doing business. So E&O isn’t only a safety measure—it’s also a competitive advantage.

How to Pick the Best E&O Coverage

Choosing an E&O policy doesn’t need to be complicated. Follow these steps:

- Identify your risks – What can go wrong in your profession?

- Compare quotes – Don’t accept the first one you see.

- Check coverage limits – $1 million per claim is standard, but high-risk fields may need more.

- Review exclusions carefully – Know what isn’t covered before you buy.

- Consult a licensed agent – An expert can tailor your coverage to your industry.

It’s not about finding the cheapest plan—it’s about finding the right plan.

Conclusion: Safeguard Your Future and Reputation

At its core, Errors and Omissions Insurance isn’t just another expense—it’s a promise. A promise that one simple mistake won’t ruin everything you’ve built.

Even small businesses face real risks. A single lawsuit could wipe out years of effort. That’s why professionals—from real estate agents to consultants—see E&O as essential, not optional.

Mistakes happen. Accusations happen faster. E&O helps you survive both while keeping your reputation intact.

SEO Keywords (Naturally Included)

Errors and Omissions Insurance • E&O Insurance for Professionals • What Does E&O Cover • Professional Liability Insurance • E&O for Small Business • E&O Coverage • Cost of E&O Insurance • Meaning of E&O Insurance • Professional Indemnity Coverage • Business Insurance for Mistakes.