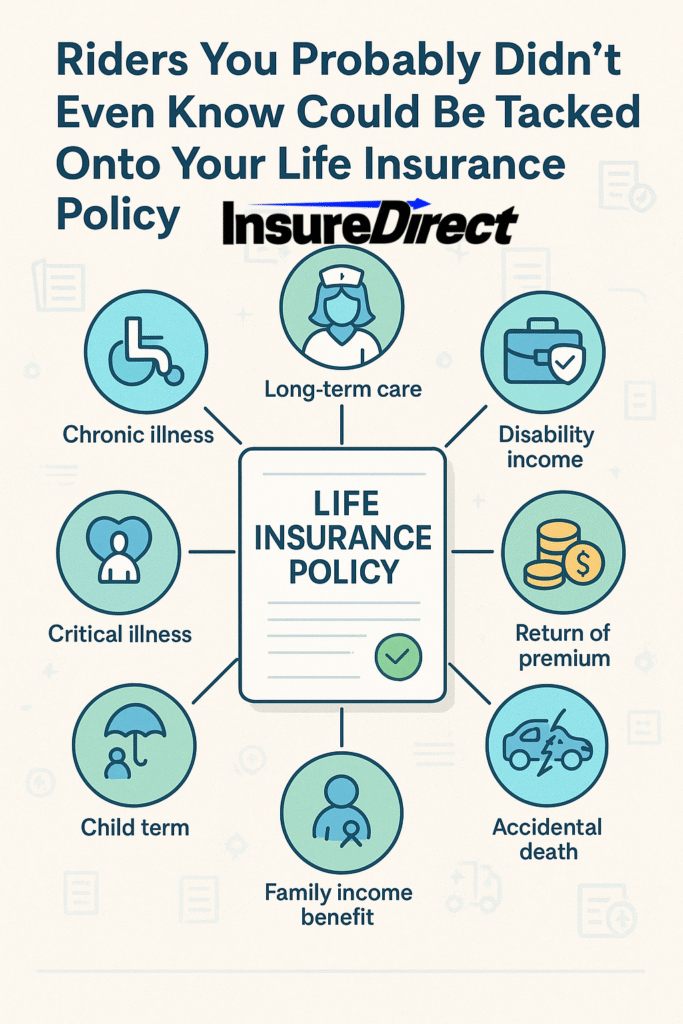

Life insurance? Sure, most people think “money after you die” and stop there. But actually, it’s like a Swiss Army knife, if you know what the hidden blades are. Riders—they’re sneaky, optional, sometimes weird, and sometimes essential. Overlook them and you’re leaving value on the table. Use them right and you’ve basically upgraded your policy from vanilla to fortress mode.

What Even Are Life Insurance Riders?

Imagine you could attach tiny superpowers to your insurance. That’s basically a rider. Extra perks that aren’t obvious, sometimes for extra cost, sometimes hidden in the small print that no one reads. Not always flashy, sometimes bizarre, but often life-saving.

Some riders are classic (accidental death), some are obscure (spouse, guaranteed insurability, or ultra-specific critical illness types). They act like little safety nets you can add over time, or at purchase. Think of them as insurance power-ups.

“Oh, I didn’t know my life policy could do that.” – Probably everyone, ever.

The Core Riders You Might Actually Want

1. Chronic Illness Rider: Cash for the Long Haul

Life throws curveballs. Chronic diseases—Alzheimer’s, MS, arthritis—don’t just disappear. This rider pays you money while you’re alive to cover therapy, home modifications, in-home care, or everyday expenses. Not a lump sum, more like a sustained financial oxygen mask.

Example: Jane, 58, progressive arthritis, paid for in-home physiotherapy for three years without digging into her savings.

Keywords: chronic illness life insurance rider, life insurance add-on for illness

2. Long-Term Care (LTC) Rider: Nursing Homes Are Expensive

Long-term care costs skyrocket. LTC riders let you tap into your policy for assisted living, home care, or medical modifications. Some integrate into death benefit—so you don’t lose everything when you need it.

Fun Fact: Some LTC riders cover ramps, stairlifts, or other home adaptations. Small changes, huge difference.

Keywords: long-term care insurance, LTC rider, life insurance for long-term care

3. Disability Income Rider: When Work Stops Paying

Life insurance can pay you while alive if illness or injury prevents work. Freelancers, gig workers, small-business owners—this is especially crucial.

Example: Tom, freelance designer, fractured spine. Disability rider paid bills for a year.

Keywords: disability income rider, life insurance disability coverage

4. Return of Premium Rider: Maybe You Get It Back

Outlive your term? Some policies return your premiums. Extra cost upfront, yes, but some consider it forced savings with perks.

Keywords: return of premium life insurance, ROP rider, life insurance with refund

5. Accidental Death Rider: Double or Nothing

Classic. Extra payout if death is accidental. Adventure seekers, extreme sports, frequent travelers—it’s for you. Usually doesn’t cover natural causes.

Keywords: accidental death life insurance, double indemnity rider

6. Child Term Rider: Protect Your Kids Too

Coverage for children under your policy. Usually small but practical—medical bills, funeral costs, college funds. Can convert to permanent later.

Keywords: child term life insurance rider, life insurance for kids

7. Family Income Benefit Rider: Monthly Payout for Survivors

Instead of a lump sum, beneficiaries get steady income. Helps cover living costs, mortgage, bills. For families, more practical than single payout.

Keywords: family income benefit, life insurance monthly payout, life insurance income rider

8. Critical Illness Rider: Lump Sum for Life’s Big Hits

Heart attacks, strokes, cancer—unexpected medical costs. This pays lump sum. You decide where it goes: bills, rehab, even a mental health retreat.

Keywords: critical illness life insurance, cancer life insurance rider, heart attack coverage rider

Extra Niche Riders You May Never Have Heard Of

9. Accelerated Death Benefit Rider

Access part of death benefit early if terminally ill. Travel, pay bills, settle affairs. Often overlooked, often priceless.

10. Waiver of Premium Rider

Illness or disability? Stop paying premiums while coverage continues. Little-known but invaluable.

11. Spouse Rider

Add your spouse to coverage. Small cost, peace of mind multiplied.

12. Guaranteed Insurability Rider

Get more coverage later regardless of health changes. Perfect for unpredictable life events.

Why Riders Are Worth Considering

Extra protection for real-world risks

Access cash while you’re alive

Bundled cost sometimes cheaper than separate policies

Peace of mind: stress relief in a volatile world

Riders aren’t “extras.” They’re your financial toolkit. Accident? Illness? Job loss? Riders help.

Keywords: benefits of life insurance riders, customizable life insurance, life insurance coverage options

How to Pick the Right Rider Without Losing Your Mind

Assess Life Situation: Age, health, dependents, debts, lifestyle

Budget: Riders cost extra. Balance coverage vs affordability

Talk to Experts: Agents, financial planners—they know quirks in small print

Read the Fine Print: Some riders expire at certain ages, or limit payout

Common Misconceptions

“Too expensive.” Small daily cost vs. thousands saved if needed

“Can add anytime.” No, some must be added at policy purchase or before age limits

“I’m healthy, don’t need it.” Life doesn’t discriminate

Real-Life Examples in Action

Chronic Illness Rider: Martha, 62, Alzheimer’s, funded home care, avoided assisted living

Disability Income Rider: Ryan, 35, broken leg, monthly benefits saved apartment and bills

Critical Illness Rider: Karen, 48, early-stage breast cancer, covered experimental treatments

These aren’t theoretical—they’re lifesaving and sanity-saving.

Innovative Uses & Trends

Telemedicine Integration: Quick diagnosis, shorter claim cycles

Predictive Analytics: Spot high-risk profiles, prevent claims proactively

Gamified Safety Training: Employees learn while entertained

Mental Health Riders: Newer policies include mental wellness support

Hybrid Riders: Combine LTC, chronic illness, and critical illness in one

Inflation Protection Riders: Benefits adjust with inflation—future-proofing

FAQs About Life Insurance Riders

Q: Can I add riders anytime?

A: Usually not. Some must be added at policy inception.

Q: Are riders expensive?

A: Most cost pennies a day; some are significant. Balance risk vs cost.

Q: Do all policies have the same riders?

A: No. Each insurer has unique offerings and limitations. Always check carefully.

Q: Can I remove a rider?

A: Usually yes, but check for refund policies or fee penalties.

Conclusion: Don’t Sleep on Life Insurance Riders

Life insurance isn’t just a payout at death. It’s a toolkit for the unpredictable. Riders: chronic illness, LTC, disability, accidental death, spouse, child coverage, guaranteed insurability—they add layers, flexibility, and peace of mind.

Pay a little more today. Sleep better tonight. A rider you never knew could end up being your most valuable financial tool tomorrow.

Keywords Recap: life insurance riders, best life insurance add-ons, enhance life insurance policy, life insurance protection, customizable insurance coverage

Contact InsureDirect

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Keep your home safe and secure with complete protection from InsureDirect—because your home deserves nothing less than the best.