Ever wondered why two folks snatch up identical life insurance plans yet fork over wildly different cash? It ain’t luck nor favoritism—math, risk, and a dash of science rule the game.

Your premium, that regular payment keeping coverage alive, doesn’t pop up by chance. Who you are, how you roll through life, and the protection you pick shape it. Basically, lower risk to insurers means a lighter wallet hit.

This piece unpacks, in everyday lingo, what drives your life insurance premium—and hints at trimming it without ditching solid coverage.

What’s a Life Insurance Premium, Anyway?

Plain talk: your premium’s the cost for some peace of mind. You might pay monthly, quarterly, or yearly—whatever suits.

In return, the insurance crew pledges a death benefit to your folks if you kick the bucket while covered. Simple enough, huh?

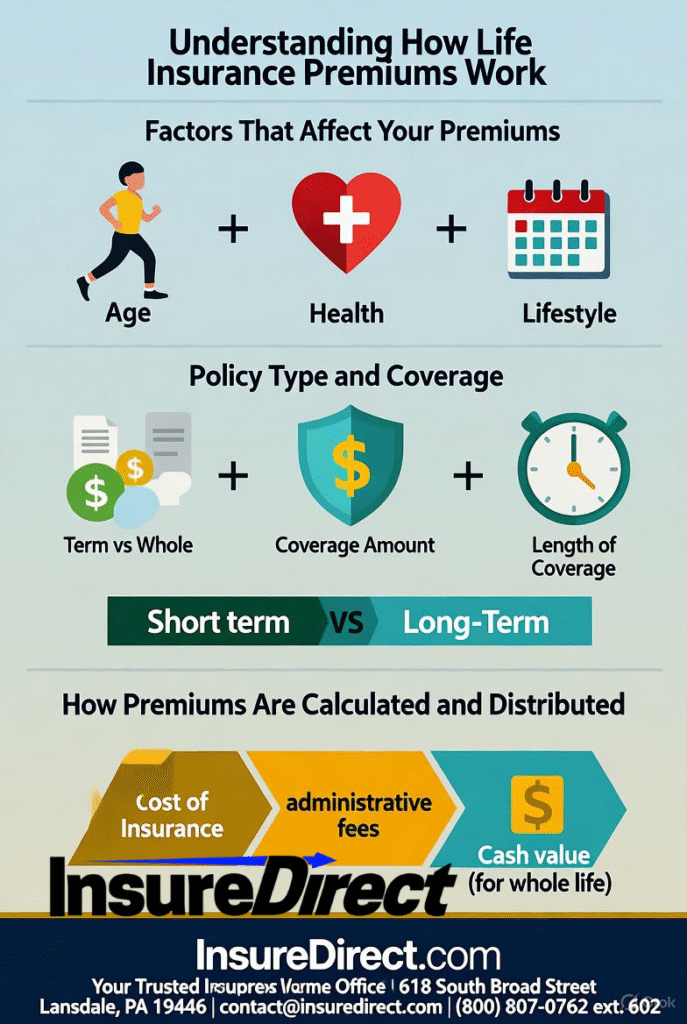

But prices vary ‘cause everyone’s risk level differs. Insurers don’t gamble—they crunch numbers using stuff like age, health, and habits to nail your rate.

Big Factors Messing with Your Premium

Insurers ain’t tossing dice. They use underwriting—a deep dive into risk—judging who you are and how soon you might claim. Here’s what mostly sways your cost.

Age—Where It All Starts

First up, age—predictable as sunrise. Snag life insurance young, and it’s cheaper—always.

Younger bodies tend to be healthier, less likely to check out soon. As years pile on, risk climbs, boosting premiums.

💡 Quick hint: Don’t stall on coverage. Each year you wait, costs creep higher.

Health and Medical Past

Health looms large. Most insurers demand a medical check—blood pressure, cholesterol, fitness all get a look.

Chronic woes like diabetes or obesity? Premiums might jump. Even family health history could tweak your rate—genetics intrigue insurers.

💬 Wise move: Tend to yourself. Exercise, eat decent, get checkups. Better health stretches life and shrinks insurance bills.

Gender’s Role

Gender tweaks your rate—beyond your control. Women outlive men statistically, so they often score lower premiums for the same cover. Just data insurers lean on.

Job and Hobbies

Your gig might seem tame, but some jobs scream risk to insurers. Firefighters, pilots, construction crews pay more than desk jockeys.

Hobbies count too—skydiving or deep-sea diving? Rates might climb.

✅ Tip: Be real about your work or play. Hiding risky fun could nix your policy later—don’t risk it.

Smoking and Booze

Smokers, brace yourself—insurance costs soar. Smoking jacks up health risks, and insurers charge for it.

Heavy drinking does similar damage. Casual sips? Usually cool. But past DUIs or overuse? Red flags fly.

🌿 Good news: Many insurers reassess after a year smoke-free. Quitting could halve your premium.

Coverage Type and Size

Policies differ. Your choice and coverage amount set the price.

Term Life’s cheap and clear—covers you for a set span, like 20 years.

Whole Life lasts forever, builds cash value, but costs more upfront with flexibility.

More coverage, higher price—but balance is key.

💡 Tip: Use a calculator to gauge what your family needs, not wild guesses.

Lifestyle and Driving

Surprise—your driving habits influence premiums. A clean record helps; tickets or crashes hike costs.

Lifestyle matters—fitness, diet, stress, risky behavior. Healthier, safer habits mean cheaper policies.

Where You Live

Location plays a minor role. High-accident zones or risky environments bump premiums. Longer-life areas might offer better deals.

Term vs. Whole Life: Premium Differences

Your policy type swings the cost big-time.

Term Life’s straightforward, affordable—covers a fixed term, like 20 years, then stops unless renewed.

Whole Life offers lifelong protection with a cash value that grows. Pricier initially, it’s more versatile long-term.

It’s less about “best” and more about fitting your life and wallet.

Tricks to Slash Your Premium

You can’t rewind age or swap gender, but other factors bend. Try these:

Jump in early—youth saves cash.

Stay fit—move, eat right, ease stress.

Ditch smoking—big savings there.

Shop quotes—insurers price differently.

Go term—it’s cheaper, often enough.

Pay yearly—some offer discounts.

Small tweaks over time cut costs big.

Why Life Insurance Rocks

It’s not just a bill—it’s a safety net. Covers debts, funerals, lost income for your loved ones if you’re gone.

Peace of mind comes with knowing they’re secure in tough times.

Whether term or whole, it’s love in action—shielding those who rely on you.

Wrap-Up: Act Now, Stay Covered

Your premium mirrors your lifestyle, health, and risks—but early moves give you the edge.

Start today. Compare quotes, live well, balance protection and price. Waiting rarely pays off; acting early does.

Contact Us

InsureDirect.com

Main Office Base

618 South Broad Street

Lansdale, Pennsylvania 19446

📧 Drop a line: contact@insuredirect.com

📞 Ring us: (800) 807-0762 ext. 602

Keep your home safe with InsureDirect’s top-notch protection—your haven deserves it!