Life insurance. Yeah, it’s confusing. A mix of necessity, cash, and stress all rolled into one. I used to think it was “term” or “whole life” and that was it. Turns out? There’s way more nuance than that. Seriously.

You want coverage, but questions pop up instantly: how much to pay, what grows, what won’t, what lasts forever, what expires? Dizzying. But let’s untangle it.

What Is Term Life Insurance?

Term life is like renting protection. You pick a period—10, 20, sometimes 30 years—pay premiums, and if something happens within that time, the payout goes to your chosen beneficiaries. Outlive the term? Nada. Zero. Zilch.

Why is useful:

- Simple. Really simple.

- Lower premiums. Great for young professionals, families, or people starting financial planning.

- Covers short-term obligations: mortgages, children’s college funds, or personal loans.

Limitations:

- Once the term ends, coverage ends.

- Renewals can be very expensive.

- Flexibility exists sometimes—you can convert certain term policies to whole life later.

Whole Life Insurance: The Long Game

Whole life insurance is a totally different story. Premiums are higher, yes. But coverage? Lifetime. And that’s not all—cash value builds too. Slowly, steadily, like a hidden savings account within your policy.

Yes, you can borrow against it. Emergency cash, retirement supplement, estate planning, or intergenerational wealth—whole life can cover all of that.

Things to consider:

- Premiums can be steep, sometimes prohibitive.

- Cash value growth is slow initially.

- Guaranteed lifetime coverage, stability, and predictability make it worthwhile if affordable.

Term vs Whole Life: Side-by-Side

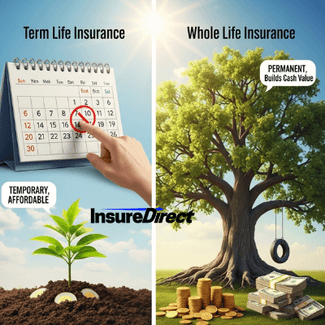

Sometimes visuals help. Here’s a simple comparison:

| Duration | Fixed term, 10–30 years | Forever (as long as you pay) |

| Premium | Low, simple | High, level |

| Cash Value | None | Accumulates over time |

| Purpose | Short-term obligations | Long-term security & legacy |

| Flexibility | Some convert options | Borrow against cash value |

Looking at it this way? Clears the fog.

Pros and Cons

Term Life Pros:

- Affordable, especially if you start young.

- Easy to understand.

- Covers short-term needs effectively.

Term Life Cons:

- Coverage ends eventually.

- No cash value.

- Renewals after the term are costly.

Whole Life Pros:

- Permanent, guaranteed coverage.

- Cash value grows steadily.

- Useful for estate planning, borrowing, or supplemental investments.

Whole Life Cons:

- Higher premiums.

- More complex than term policies.

- Cash value growth starts slowly.

How to Decide What’s Right for You

Ask yourself a few questions:

- Budget: Can you afford high premiums? The term is cheaper.

- Coverage horizon: Short-term obligations or lifelong protection?

- Goals: Immediate debts, college, or long-term wealth?

- Investment strategy: Whole life grows slowly inside the policy; term plus separate investments may outperform depending on your risk tolerance.

Hybrid approach? Term covers immediate needs, whole life secures long-term protection. Balanced, reasonable, and flexible.

Unexpected Benefits of Life Insurance

It’s not just “after you die”:

- Borrow cash value: Whole life allows loans against your policy.

- Tax benefits: Cash value growth can be tax-deferred.

- Estate planning: Transfer wealth efficiently to heirs.

- Business continuity: Key-person insurance or buy-sell agreements use life insurance.

- Peace of mind: Knowing you’re covered is invaluable.

Even term policies provide huge reassurance during critical financial windows.

Real-Life Scenarios

- Young couple with mortgage & kids: 20-year term life covers debts and tuition. Low premiums keep cash flow steady.

- An entrepreneur starting a business: Whole life provides cash value that can be tapped for emergencies.

- High-net-worth individual: Whole life helps with estate planning, tax-efficient wealth transfer, and lifetime coverage.

Seeing examples makes it less abstract.

Common Misconceptions

- Term is “wasted” if you outlive it: False. It covers debts and temporary obligations.

- Whole life is the best “investment”: Not always; compare returns to other investment options.

- Premiums are fixed forever: Some term policies increase on renewal. Whole life usually level.

- You can’t change your mind: Most policies offer conversion options or riders. Flexibility exists.

Tips for Choosing a Policy

- Evaluate your commitments: mortgage, loans, kids’ education. The term often covers these.

- Consider your long-term planning: whole life if you want permanent coverage or estate planning.

- Review flexibility: convertibility, optional riders, and additional coverage.

- Analyze cost vs benefit: don’t overcommit early, but don’t underinsure.

Budgeting Life Insurance

- Term life: Low, predictable monthly premiums; easy to include in your budget.

- Whole life: Higher monthly premiums, long-term commitment, cash value growth over time.

- Hybrid approach: Combine term and small whole life for affordability and long-term security.

Many financial advisors suggest a term in early career and adding whole life as income grows.

How InsureDirect Can Help

Getting coverage doesn’t need to be confusing. InsureDirect offers:

- Simple online quotes

- Human guidance

- Flexible coverage options

- Tailored policies for term, whole life, or hybrid strategies

Contact Info:

- Website: InsureDirect.com

- Phone: (800) 807-0762 ext. 602

- Email: contact@insuredirect.com

- Office: 618 South Broad Street, Lansdale, Pennsylvania 19446

Fast quotes, real people, flexible options—coverage made simple.

Conclusion

Life insurance isn’t one-size-fits-all. The term is simple, cheap, and temporary. Whole life is permanent, flexible, but expensive. Knowing the difference provides clarity and peace of mind. Protecting your family doesn’t have to be intimidating.

Short-term or long-term, term or whole life, or a combination—understanding your options is the key. Peace of mind? Priceless.

Keep your home safe and secure with complete protection from InsureDirect—because your home deserves nothing less than the best.

InsureDirect.com

Corporate Home Office

618 South Broad Street, Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Corporate Home Office

618 South Broad Street, Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602