Ya know, I’ve been around the block when it comes to business insurance stuff—especially E&O. Some folks call it Errors and Omissions insurance, others say it’s professional liability, and to be real honest? It’s all kinda the same deal. You mess up, insurance steps in (hopefully). But the thing most people keep asking is: how much is this gonna set me back every month?

Well… That’s a loaded Q.

Some pay $20, some way more. $90? Even $150 sometimes. Why? Depends. Lotta reasons.

Wait, What’s E&O Insurance Again?

Lemme back up. I should’ve said this sooner but—E&O is like your safety net if you’re a consultant, designer, real estate person, or even like, an accountant or lawyer. Basically, if your work involves advice or services? You might need it.

You slip up, or someone thinks you did? Boom. They sue. Happens fast. This insurance can cover legal fees, settlement costs, all that drama.

I mean—imagine somebody says, “You cost me 50 grand!” Even if you didn’t. Still gotta defend yourself. This policy’s for that.

So… What’s It Cost Per Month?

Tbh, depends who you ask. No cookie cutter pricing here. My buddy Sarah’s a freelance writer—pays like 22 bucks. Meanwhile, a tech startup CEO I know? Pays closer to 140 monthly.

Here’s a ballpark I scribbled down a while ago:

| Type of Business | Monthly Range (Est.) |

|---|---|

| Freelancer / Solo operator | $20–$40 |

| Small biz (few employees) | $45–$70 |

| Higher risk / Complex ops | $75–$150+ |

But don’t quote me exactly. Insurance math be wild sometimes.

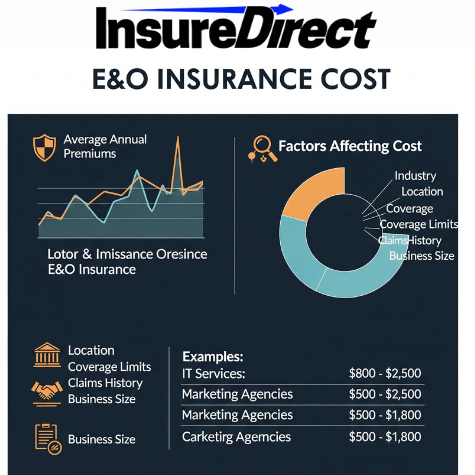

The Why Behind the Price Tag

Now lemme tell you why prices vary all over the place.

1. Your Industry = Big Deal

Some jobs be low-risk (graphic designers, sometimes), and others? Not so much. Think lawyers, insurance agents, or financial advisors. Big-time liability.

2. How Long You Been At It

Newbies might pay more, just ’cause insurers don’t know you. Track record ain’t there yet.

3. Past Trouble?

Ever been sued before? Had claims filed? Yeah… they’ll see that. Expect the cost to climb like a ladder.

4. What’s Your Coverage Limit?

Wanna be covered for $1M per incident? Cool. You’ll pay X. But say you want $5M? Bigger price tag. Makes sense tho.

5. The Deductible Game

Lower deductible = higher monthly price. Raise that deductible? Pay less per month, but be ready to cough up more if a claim drops.

6. Where You At Matters

Live in NYC or Cali? Premiums gonna be fatter. More lawsuits, more risk, more cost.

Wanna Save Money? Here’s Some Tricks

I’ll spill a few of my secrets here:

Bundle that sh*t. General liability + E&O? Cheaper together.

Pay yearly if you can swing it. Saves a few percent.

Comparison shop. Every. Single. Time.

High deductible if you’re feeling brave (but smart about it).

Stay clean—no claims = better rates over time.

And don’t just go with the first quote. Some of these insurance sites will show you rates from 6–7 companies. Use ‘em.

Story Time (Quick One)

Okay so—client of mine, branding consultant. Got sued by a client over a “strategy failure.” Their words, not hers. Claimed $80K in lost revenue. Crazy, right?

She had E&O. Paid a $1K deductible. Her insurer covered the rest. If she didn’t? Let’s just say she wouldn’t still be in business.

Moral of the story: don’t be uninsured in a litigious world.

So… Worth It?

You still wondering if you need it? I mean—I pay around $60/month, and that’s peace of mind I’ll never regret. I sleep better knowing one accidental oversight won’t bankrupt me.

One lawsuit, and that small premium feels like nothing. Literally.

Even if it’s just to keep clients happy (some require it), it’s a small price for a shield.

Wrap Up: What’s the Bottom Line?

Alright. Here’s the TL;DR (but not really TL;DR ’cause you’re already down here):

E&O insurance = monthly cost from $20 to $150+, depending on your biz, your risk, and your coverage.

If you’re looking for top-quality insurance coverage, InsureDirect is your go-to choice. Getting a home insurance quote is fast and simple. Visit our website or reach out to our corporate office at:

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

contact@insuredirect.com

Phone: (800) 807-0762 ext. 602

Protect your home and enjoy peace of mind with the reliable insurance solutions from InsureDirect. Because your home deserves the very best.