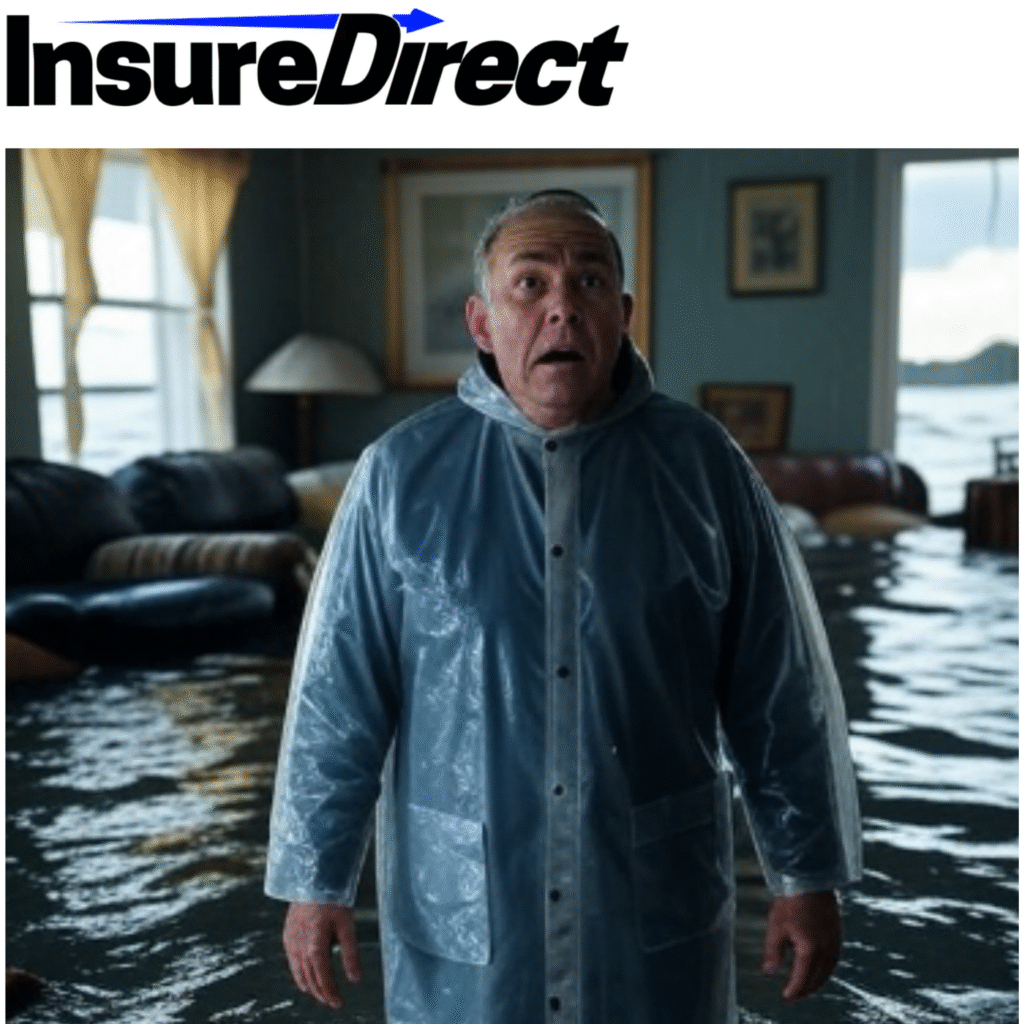

Floods are the most common and costly natural disaster in the United States, affecting every state and territory. Yet, a pervasive misconception persists: “It won’t happen to me.” Many believe flood insurance is only for those living in designated high-risk flood zones, or right on the coastline or riverbanks. The truth, however, is far more encompassing. If you own property, run a business, or even rent a home, understanding your flood risk and the critical role of flood insurance is paramount to safeguarding your financial future.

The Unseen Threat: Why Everyone Has Some Flood Risk

Standard homeowners’ and renters’ insurance policies do not cover flood damage. This is a crucial detail that many discover only after a devastating event, leaving them financially vulnerable. So, if your regular policy won’t protect you, who then truly needs flood insurance? The answer, surprisingly, is almost everyone.

Consider these often-overlooked scenarios:

- Beyond the Flood Zone: Nearly one-third of all National Flood Insurance Program (NFIP) claims come from properties outside of high-risk flood zones. A heavy downpour, rapid snowmelt, or even a broken water main can lead to localized flooding, impacting areas typically considered “safe.” New construction altering drainage patterns can also create unexpected flood risks.

- The Power of Inches: Just an inch of water in your home can cause over $25,000 in damage to your property and belongings. Without flood insurance, these costs fall entirely on your shoulders.

- Climate Change and Shifting Risks: Changing weather patterns are leading to more frequent and intense rainfall events, increasing flood risks in areas that were historically less susceptible. What might have been considered a low-risk area a decade ago could be facing a new reality today.

- Disaster Assistance Limitations: Federal disaster assistance, when available, often comes in the form of low-interest loans that must be repaid. It’s designed to kickstart recovery, not cover the full extent of losses, and it’s only declared after major events. Flood insurance, on the other hand, provides direct financial aid regardless of a presidential disaster declaration.

Who Specifically Should Prioritize Flood Insurance?

While the general rule is that everyone has some risk, certain groups face a more immediate and significant need for flood insurance:

1. Homeowners (Especially in High-Risk Zones)

If you have a mortgage from a federally regulated or insured lender and your home is located in a Special Flood Hazard Area (SFHA), also known as a high-risk flood zone (zones starting with A or V on FEMA flood maps), flood insurance is mandatory. Your lender will require it as a condition of your loan.

However, even if your home is in a moderate or low-risk zone, consider these points:

- It’s Not If, But When: Floods can happen anywhere. Don’t rely solely on flood maps, which represent historical data and may not fully reflect evolving risks.

- Protecting Your Investment: Your home is likely your most significant asset. Flood damage can be catastrophic, jeopardizing years of savings and hard work. Flood insurance protects that investment, covering structural damage to your home, including the foundation, walls, electrical and plumbing systems, and built-in appliances.

2. Renters

Many renters mistakenly believe their landlord’s insurance covers their personal belongings in the event of a flood. This is almost never the case. A landlord’s policy will only cover the physical structure of the building. Your personal property—furniture, electronics, clothing, and other valuables—would be a total loss without a separate renters flood insurance policy.

Renters flood insurance (often a contents-only policy through the NFIP) is an affordable way to protect your possessions from the financial devastation of a flood. Imagine losing everything you own and having to replace it all out-of-pocket – renters flood insurance prevents this scenario.

3. Business Owners

Flooding can cripple a business, leading to extensive property damage, loss of inventory, and significant business interruption. Most commercial property insurance policies, like homeowners’ policies, do not cover flood damage.

Commercial flood insurance is vital for:

- Protecting Your Physical Assets: This covers damage to your business building, equipment, machinery, and fixtures.

- Safeguarding Inventory: Whether you sell products or rely on raw materials, flood insurance can help cover the cost of damaged inventory.

- Rebuilding and Recovery: Without insurance, the cost of repairing or rebuilding after a flood can be insurmountable for many small businesses, forcing them to close their doors permanently. While business interruption coverage is typically not included in standard flood policies, having the funds to repair physical damage is the first step toward getting back on your feet.

How to Get Flood Insurance

The primary source of flood insurance in the United States is the InsureDirect Flood Insurance, administered by the Federal Emergency Management Agency (FEMA). You can purchase NFIP policies through local insurance agents.

In recent years, a growing private flood insurance market has emerged. Private insurers may offer:

- Higher Coverage Limits: Beyond the NFIP’s maximums ($250,000 for building coverage and $100,000 for contents for residential properties).

- Broader Coverage Options: Such as loss of use coverage (for temporary living expenses if your home becomes uninhabitable) or coverage for belongings in basements (which the NFIP often has limitations on).

- Potentially Shorter Waiting Periods: NFIP policies typically have a 30-day waiting period before coverage takes effect, while some private policies may have shorter waiting periods (e.g., 15 days).

It’s wise to compare options from both the NFIP and private insurers to find the policy that best suits your needs and risk profile.

Understanding the Cost and Benefits

The cost of flood insurance varies based on several factors, including your property’s flood risk zone, elevation, the amount of coverage, and deductible. FEMA’s Risk Rating 2.0 methodology now aims to more accurately reflect individual property risks, considering factors like flood frequency and the cost to rebuild. While premiums can range, the financial burden of flood damage without insurance almost always far outweighs the cost of a policy.

The benefits of having flood insurance extend far beyond financial protection:

- Peace of Mind: Knowing your property and belongings are protected brings invaluable peace of mind, especially during severe weather events.

- Faster Recovery: Flood insurance provides direct funds for repairs and replacement, enabling a quicker and more complete recovery process.

- Avoid Debt: Without insurance, you might have to deplete savings, take on high-interest loans, or rely on often insufficient and delayed federal assistance.

- Community Resilience: When more properties are insured, communities can recover more quickly and effectively from flood events, as resources are distributed more efficiently.

Don’t Wait Until It’s Too Late

The biggest mistake you can make regarding flood insurance is waiting until a storm is on the horizon or a flood is imminent. There is almost always a waiting period before a policy takes effect. By then, it’s too late.

Take the proactive step today. Research your flood risk using FEMA’s Flood Map Service Center, contact an insurance agent to discuss your options, and secure the protection you need. Flooding is an undeniable reality. Being prepared with flood insurance isn’t just a smart financial decision; it’s a vital act of self-preservation for your home, your business, and your future.