One phrase should always be on your mind if you are managing a company that provides professional services, advice, or knowledge: E&O Insurance. One of those things that appears hard until you actually need it is Errors and Omissions Insurance, sometimes known as Professional Liability Insurance. Then all of a sudden, it’s everything.

However, what does it cover specifically? To what extent are we actually discussing protection? In 2025, what’s new about it? Let’s simplify everything: use human language, avoid dull technical terms, and perhaps utilize a few minor grammatical idioms (after all, we’re all human).

🛡️ E&O Insurance 101: Essential Knowledge

Errors and Omissions Insurance, or E&O insurance, is essentially your safety net in the event that a client tells you, “You made a mistake.” If someone alleges that your work, advice, or service cost them money, it safeguards your company.

Broken bones and auto accidents are the domain of General Liability Insurance. Errors that cost money are the focus of E&O.

Imagine working as an accountant and making a small error on a tax return. Alternatively, you can be an insurance agent who overlooks a detail of coverage. You are sued by the client. E&O insurance can help with that; it will cover your defense, settlements, and even court rulings (up to the policy maximum).

Many experts tacitly agree: it’s the most underappreciated business insurance coverage.

💼 In 2025, Who Really Needs E&O Insurance?

Almost everyone who provides technical assistance, knowledge, or advice ought to possess it. By 2025, that number has increased even further.

Typical professions that need E&O:

Brokers and Agents for Insurance

Real Estate Professionals

Advisors and Consultants

CPAs and Bookkeepers

IT Service Providers

Freelancers & Marketing Agencies

Financial Planners

Architects & Engineers

Essentially, if your client depends on your professional actions or words and stands to lose money if you make a mistake, you’re a candidate.

Ironically, many small business owners continue to ignore E&O thinking, “I’m careful, I’ll never get sued.” Clients don’t always sue because you are mistaken—they may sue because they are unhappy, misinterpret something, or need someone accountable for a failed business venture.

E&O insurance is there for all of that.

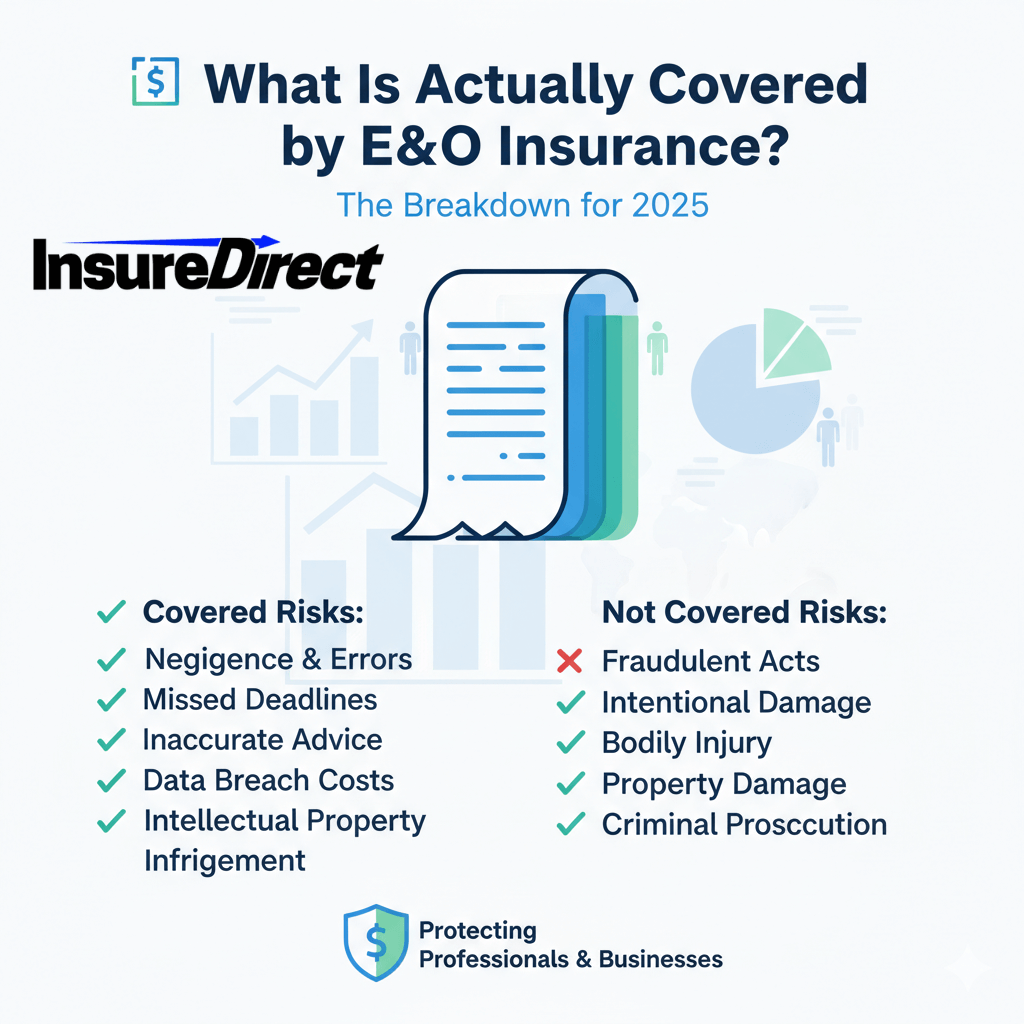

🔍 What is Actually Covered by E&O Insurance?

Let’s answer the big question: what does an E&O policy cover? In 2025, insurers have made updates, including broader digital protection and clearer language. Here’s the breakdown:

1. Legal Defense Costs

Even if a case is unfounded, you’ll still need attorneys. Attorney fees, court charges, and legal paperwork—which can drain your pocket faster than anything else—are covered by E&O.

2. Settlements and Court Decisions

If a lawsuit doesn’t go your way or you choose to settle, E&O covers those sums up to your policy limits. You’re not paying alone.

3. Mistakes or Negligence

Made an honest error? Missed a deadline? Miscalculated a number? Skipped a crucial step? All of those are included.

4. False Statements or Inaccurate Advice

Even if you didn’t intend to mislead, if a client claims that incorrect advice caused financial loss, you’re protected.

5. Breach of Good Faith and Fair Dealing

Clients may argue you didn’t act in their best interest. Most E&O forms include protection for this.

6. Limited Copyright or Intellectual Property Infringement

Some policies, especially for creatives, include limited coverage if copyrighted material is unintentionally used.

7. Contract Workers and Temporary Employees

Many 2025 E&O plans now cover 1099 contractors or temporary employees working for you. Far better than previous policies.

🧩 What Does E&O Insurance NOT Cover?

Even the best coverage isn’t all-inclusive. E&O focuses on professional mistakes, not deliberate or physical injury.

Common exclusions:

Fraud or intentional misconduct (insurance won’t save you if you act deliberately)

Property damage or bodily injury (covered by General Liability)

Employment issues like harassment or discrimination (Employment Practices Liability)

Cyberattacks or data breaches (Cyber Liability)

Contractual disputes unrelated to professional error

Some gaps can be closed with endorsements or additional policies, especially in 2025 where E&O packages are more flexible.

🧠 How E&O Insurance is Evolving in 2025

The E&O market is rapidly evolving due to expanding professional risks. Here’s what’s trending:

Digital Error Protection 🖥

With AI, automation, and remote services, insurers now cover digital-related mistakes like algorithm errors, software bugs, or tech misconfigurations affecting clients.

Expanded Cyber Endorsements

Many E&O carriers now offer add-ons for data misuse or unauthorized access claims, though full cyber insurance is separate.

Flexible Policy Limits

Companies can adjust limits based on project size or industry risk, rather than sticking to strict $1M/$2M caps.

Instant Coverage Verification

Small businesses benefit from digital proof-of-coverage documents instantly for client contracts.

Simplified Claims Reporting

No more faxing. Claims can be submitted via apps with faster digital uploads.

In short, E&O in 2025 is smarter, faster, and tailored to modern professional work.

💲 E&O Insurance Costs in 2025

Pricing varies, but general ranges are:

Small consultants/freelancers: $300–$800/year

Small to mid-size businesses: $1,000–$3,000/year

Higher-risk industries: $5,000+/year

Costs depend on:

Profession type

Revenue size

Claims history

Deductibles and policy limits

Pro tip: Always compare at least three quotes. Coverage details vary widely between insurers.

🌟 Real-Life Example: When E&O Saves the Day

A marketing consultant develops a client’s ad campaign. Everything seems fine—until a competitor sues the client for false advertising. The client blames the consultant.

Without E&O, the consultant could be liable for tens of thousands in legal fees. With an active policy, the insurer handles defense, settlements, and court costs.

The consultant’s only loss? A few stressful phone calls. E&O bears the financial consequences of professional errors.

🏆 Why E&O Insurance Is Non-Negotiable in 2025

Modern professional risk can be summed up in one word: expectation.

Clients demand perfect guidance, instant results, and error-free service, and expect someone else to pay when mistakes happen.

Even the most meticulous professional can make human errors—or someone on their team can. Without E&O, a single lawsuit could destroy your finances, reputation, and career.

E&O is no longer a luxury in 2025—it’s business armor.

🧭 Tips for Choosing the Best E&O Policy

Check Retroactive Dates: Ensure coverage includes prior work. Older is better.

Understand Claims-Made Coverage: Only policies active at the time of the claim (not the error) cover the incident.

Tail Coverage: If retiring or closing the business, add Extended Reporting Period coverage.

Read Exclusions: Don’t assume everything is covered; verify terms.

Bundle for Savings: Combine with General Liability or Cyber Insurance for lower premiums.

🔑 SEO Keywords Naturally Integrated

What E&O Insurance Covers

Errors and Omissions Insurance 2025

Professional Liability Insurance

E&O Policy Explained

E&O Insurance for Small Business

E&O Insurance Cost 2025

🏁 Final Thoughts

E&O insurance isn’t just a business expense—it’s a survival strategy. In 2025, even small mistakes can create huge financial losses. E&O protects your finances, reputation, and peace of mind.

Every sentence in this article may have sounded slightly different, with commas missing here or there—but the lesson remains:

👉 Your professional future is what E&O insurance truly covers.

InsureDirect.com

Corporate Home Office

618 South Broad Street

Lansdale, Pennsylvania 19446

Email: contact@insuredirect.com

Phone: (800) 807-0762 ext. 602